Financial and you can Extra revelation

This might be An advertisement. You are not Expected to Make any Fee Or take People Almost every other Step As a result To that particular Offer.

Earnest: $1,000 to own $100K or higher, $200 getting $50K in order to $. To possess Earnest, if you re-finance $100,000 or maybe more from this web site, $500 of your $1,000 bucks incentive exists physically because of the Student loan Coordinator. Price diversity significantly more than has elective 0.25% Car Spend discount.

Having loan terminology more fifteen years, the pace will never exceed %

Small print pertain. So you’re able to be eligible for it Earnest Incentive bring: 1) no one should currently feel a serious visitors, or have obtained the main benefit in past times, 2) you need to complete a done education loan refinancing app from the appointed Education loan Planner link; 3) you need to render a legitimate email and you will a valid checking membership matter inside the application procedure; and you may cuatro) the loan must be completely disbursed.

You’ll discovered a beneficial $1,000 added bonus for many who refinance $100,000 or more, or a great $two hundred bonus for individuals who re-finance an amount from $50,000 so you can $99,. Serious will instantly transmitted $500 with the checking account after the latest disbursement. To the $two hundred Invited Extra provide, Serious have a tendency to automatically broadcast the brand new $2 hundred added bonus to the checking account after the finally disbursement. There is a threshold of just one extra each debtor. It offer is not legitimate having current Serious customers whom refinance their existing Earnest loans, members with in past times gotten a bonus, or having some other extra also provides received from Earnest thru it or any other station. Incentive cannot be provided in order to owners during the KY, MA, or MI.

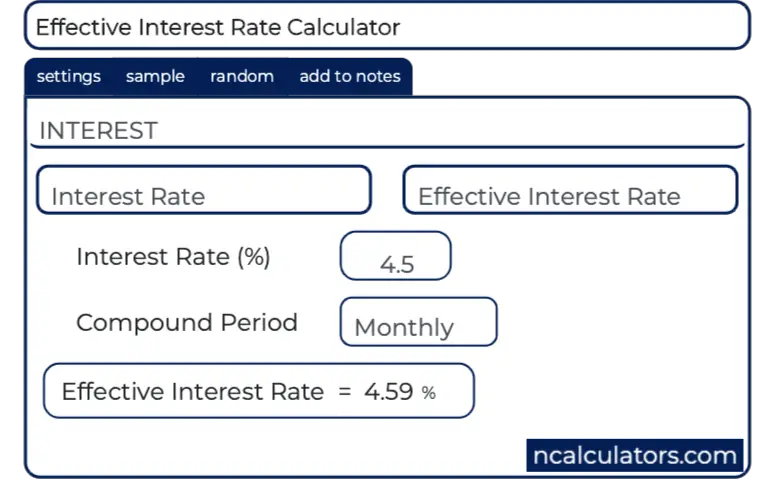

Real price and you may offered fees terminology will vary predicated on the earnings. Fixed rates are priced between cuatro.24% Annual percentage rate to help you nine.99% Annual percentage rate (excludes 0.25% Vehicle Pay disregard). Changeable rates are normally taken for 5.99% Annual percentage rate so you’re able to 9.99% Apr (excludes 0.25% Auto Spend dismiss). Earnest adjustable rate of interest student loan refinance loans are based on a publicly available index, brand new 29-time Average Shielded Overnight Resource Rates (SOFR) compiled by the Government Put aside Bank of brand new York. The latest adjustable price will be based upon the interest rate published to your 25th time, or the second business day, of before 30 days, round with the nearest hundredth out-of a percentage. The interest rate doesn’t raise more than once four weeks. The utmost rate for the financing was 8.95% in case the mortgage name try ten years otherwise smaller. For financing terms of more a decade to 15 years, the speed cannot go beyond 9.95%. Take note, we are not capable offer varying rate financing in AK, IL, MN, NH, OH, TN, and you may Colorado. All of our reasonable rates are merely readily available for all of our really borrowing from the bank certified borrowers and you will contain our very own .25% auto shell out discount of a monitoring or checking account.

You could potentially enjoy the Vehicles Shell out interest rate reduction by the installing and you can keeping active and you may automatic ACH withdrawal off the loan percentage. The interest rate avoidance to own Car Shell out was offered just whenever you are your loan try subscribed to Car Spend. Interest rate incentives to have utilizing Auto Pay may possibly not be shared that have particular personal education loan payment apps which also promote an enthusiastic interest rate cures. Having multiple-people money, just one cluster may enroll in Automobile Shell out.

Earnest readers get skip one to percentage all the 1 year. Your first demand in order to disregard an installment can be made after you’ve made about six months from straight on-time costs, along with your loan is in an effective status. The eye accrued inside the skipped few days can lead to an upsurge in your own kept lowest fee. The final incentives go out on your loan would be offered because of the the size of the fresh new overlooked percentage episodes. Please be aware that a skipped payment do matter into the brand new forbearance restrictions. Please be aware one skipping a payment is not protected which can be in the Earnest’s discernment. Your payment and full financing costs get increase while the a great consequence of postponing your fee and you may stretching their title.