John Wightman, Ombudsman Chief and you can Head regarding Routine, shows you exactly what it way to be a good guarantor into good guarantor loan.

- Send by the email address

- Tweet regarding it

- Display on the LinkedIn

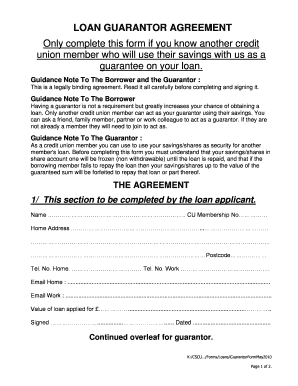

I was has just greeting to engage in a section talk towards BBC Radio 4’s Money box inform you. The latest program focussed about what it indicates is a beneficial guarantor, sometimes into the that loan, a mortgage otherwise a tenancy agreement. Particular loan providers will provide financing so you can borrowers if a new person (such as, anybody you like) promises to really make the costs in case the debtor does not, which other person is named a guarantor.

They emerged throughout the calls and connection with other panellists that both guarantors try not to completely understand just what are a good guarantor function. Therefore, I desired to talk about five trick items that anyone contemplating agreeing to make sure financing must look into.

Exactly what are the monetary liability you are taking toward?

After you invest in feel a great guarantor, your situation is far more than just vouching for the buddy or family member. You are acknowledging a formal court and monetary duty to make payments on their behalf in full.

Are you confident that the fresh new borrower helps make the brand new repayments in place of their let?

Legislation need loan providers, or people who bring borrowing from the bank, to test your debtor and you will guarantor can be for each spend the money for installment directly. Even though guarantors should be able to trust lenders in order to safely check that new borrower are able the mortgage, what is important having guarantors to appear for the that it themselves which have the fresh borrower before financing initiate. Think about, when someone are asking you to-be the guarantor, it is fine to need observe on your own just what finances he or she is in.

Do you know how or once you would be expected so you can step in?

Lenders need certainly to officially default the fresh borrower, and thus there has been failing to fulfill the fresh new court obligations of the financing, until the guarantor is actually legitimately expected to help. But many guarantors deal with a problem on the whether or not to make repayments prior to that point. This is often partially to guard new borrower away loan places Bayou La Batre AL from standard, and you can partially to end large amounts away from skipped money, or arrears, increase and this a beneficial guarantor you’ll later on need to pay during the you to definitely wade (possibly that have focus).

- when and how they will certainly tell you about people overlooked payments

- the way they work into borrower locate straight back to the song in advance of forcing this new guarantor to make repayments

- the length of time you will need to get caught up the loan money when the arrears enjoys collected

Are you comfortable with the risks you to definitely being a beneficial guarantor presents towards the profit?

When the the fresh new debtor fails to build payments toward its loan, you may be likely to step-in. Which can has actually an immediate financial cost to you. In the event that arrears have built up this can include having to pay out of a lump sum payment in a short time, and additionally picking right up a normal payment for the left time of the loan.

Including a cost for the weight and pence, this can provides a negative impact on your own credit history, that’s a database used by loan providers to evaluate the creditworthiness. Negative indicators on your own credit reports you are going to remain visible to most other loan providers for a long time and can connect with your capability to get into credit, such fund, handmade cards, and you can mortgage loans, on your own. Along with the new poor circumstances, every courtroom mechanisms accessible to anybody implementing a debt owing to legal is applicable to a great guarantor.

Have you considered the dangers you to becoming a great guarantor presents to their matchmaking?

You can concentrate on the monetary and court effects to be a good guarantor. But these agreements are underpinned because of the friendships and family relations ties.

Regrettably, from the circumstances we see, dating and you can friendships can come significantly less than filters and could crack off entirely whenever anything go awry. Just like the difficult as it’s so you can decline a demand to behave due to the fact a guarantor, callers into the plan explained that they need they had told you no whenever to begin with requested, otherwise was indeed glad that they had said no to begin with.

The way we might help

Taking steps to get answers to these types of concerns for yourself often help you create an educated choice to you on is an effective guarantor. However, loan providers also have an obligation to check the mortgage was sensible and give you all the information you want.

If you were to think a loan provider keeps dropped small, or otherwise not handled you rather, we might have the ability to help. You will see more info on how we evaluate problems on the guarantor loans towards our very own site.