Of several home owners exactly who currently have a great speed and you can commission with the its home loan prefer to rating dollars using their present security with a property guarantee mortgage to allow them to Continue the lowest home loan price and only acquire off their current security.

In a nutshell, if you find yourself a fixed-price home collateral loan and you can a refinance loan each other assist you in order to power the residence’s security, they actually do very in a different way. Property collateral loan brings an additional financing having a fixed fees agenda, whenever you are refinancing changes new terminology or amount of your home loan.

This tend to causes large rates of interest compared to the secured loans instance home collateral loans. Signature loans along with often render less overall to help you borrowers-with several capped at the $20,000-when you find yourself a property guarantee loan might be able to bring availability so you’re able to to $five hundred,000.

Signature loans provide prompt cash at the a higher interest, and could getting suitable for those individuals in place of family equity otherwise men and women maybe not aspiring to play with their home because the equity.

Opposite mortgages are around for homeowners old 62 and you can older, letting them move part of their residence security to your bucks without the need to pay back the loan as long as they alive at home.

In place of a predetermined-price household guarantee financing, in which you make monthly installments, a face-to-face financial accrues appeal that will be maybe not owed till the resident motions aside otherwise passes away.

Of many people have fun with house guarantee financing to cover home improvements, that will increase the worth of their residence. Such as, renovations a kitchen otherwise incorporating your bathroom is a smart capital.

When you yourself have highest-attention expenses particularly charge card balance, property security loan can be used to combine this type of costs with the one, lower-desire financing, simplifying your bank account and potentially saving you currency.

A property collateral financing can help finance studies can cost you, delivering an alternative to student education loans, particularly when it’s got a diminished rate of interest.

The speed on your household security mortgage myself impacts the payment per month. A lower price setting lower money it is usually influenced by your credit rating and you may sector standards.

The word of the mortgage-how long you must pay it off-may differ. Quicker words fundamentally suggest highest monthly obligations however, straight down total desire paid, when you are stretched apply for payday loan Austin terms and conditions dispersed costs, which makes them even more in balance but improving the complete focus.

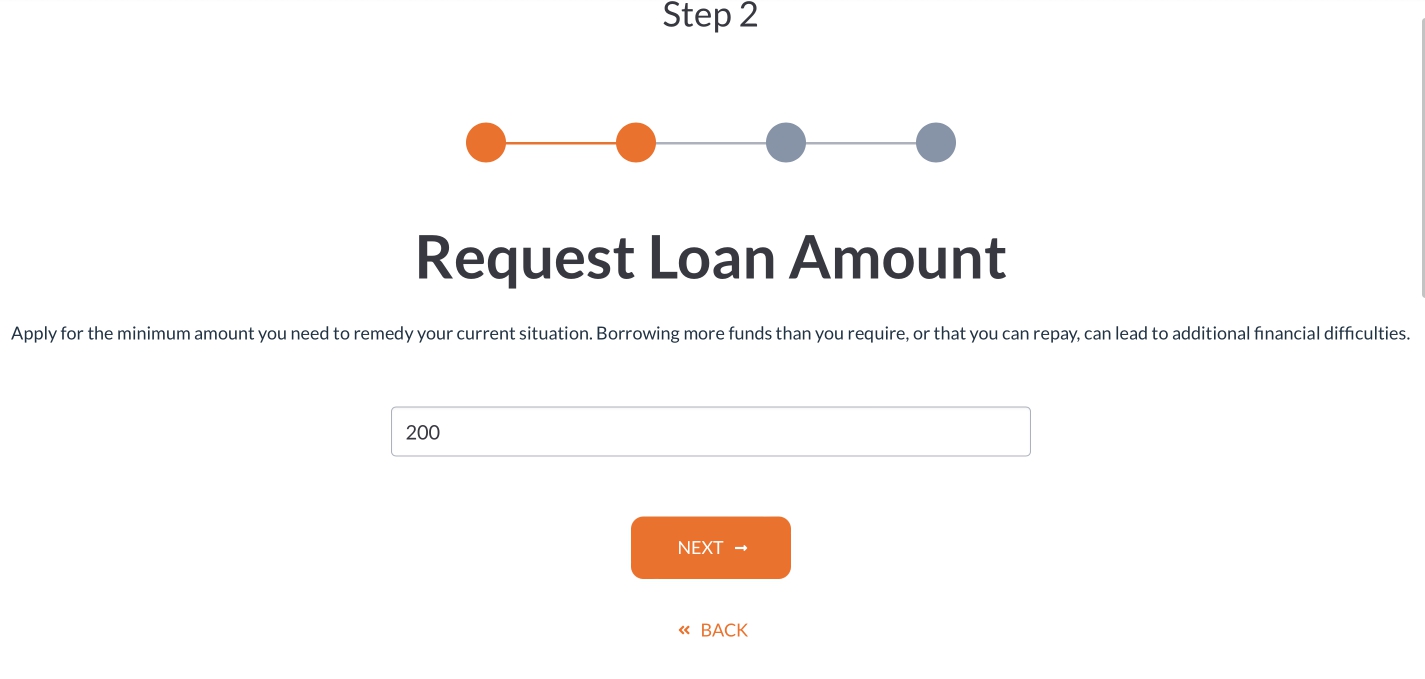

The greater the loan, the higher your own monthly payment could well be. It is important to simply borrow what you would like and everything you normally logically pay back.

Thought a citizen which have $100,000 in home guarantee who removes a beneficial $forty,000 household guarantee loan at an excellent 5% repaired interest having fifteen years. Its payment per month would be as much as $316, excluding people charges. not, when they chose a beneficial ten-season title, the new payment per month manage increase to help you approximately $424, nonetheless would pay shorter altogether notice along the lifetime of loan.

Fixed-speed domestic collateral money provide a predictable and you may quick method for people to get into funds. Of the focusing on how it change from other financing brands and you may considering your financial situation and requires, you can make an informed decision toward if or not a fixed-rate house collateral financing suits you. Think about, with your house as the security form its vital to borrow sensibly and you can think about the much time-term implications on the economic wellness.

Postings by the Mark

- HomeEquity (34)

- HELOC (31)

- CashAccess (23)

Share

*Facts to note:Springtime EQ consumers obtain money on mediocre inside 21 team months, so when prompt due to the fact 2 weeks. This mediocre day try measured ever since we receive all the expected data and you will assumes on their stated earnings, possessions and identity advice provided on your own loan application matches your data files and you may people support information obtained. The period of time formula to find cash is according to research by the mediocre resource change moments across the first four days out-of 2023, takes on the income is actually wired, excludes vacations and you can excludes government entities required revelation wishing several months. Normal applicants are required to offer a recently available and you may good done application, evidence of earnings, home loan report, household possibilities insurance coverage, and you can a photo ID.