Into the property market since scorching since it is, a lot of properties are now being offered via market and naturally so. The audience is hearing of great prices for anyone selling their functions from the auction. However, deals should be psychologically stressful and there are a handful of far more facts to consider, specifically for individuals with less than a 20% deposit, being usually very first home buyers.

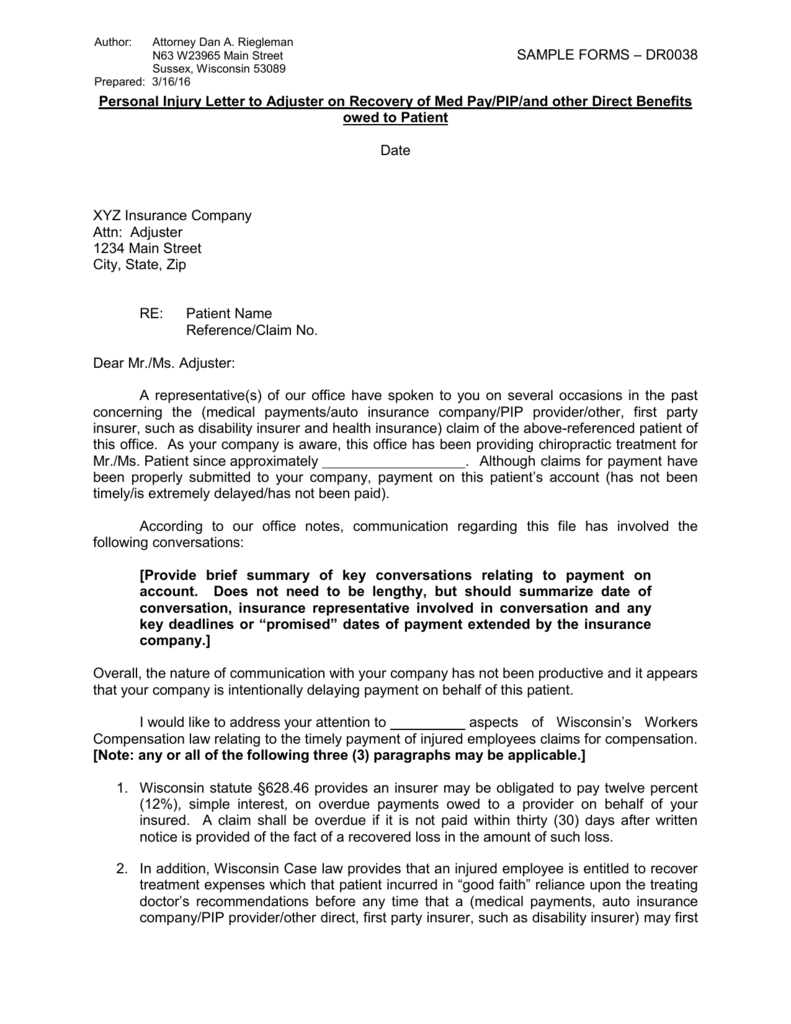

Significance of are pre acknowledged to possess fund

Just in case someone acquisitions at the public auction, despite their put, if you profit, its considered an enthusiastic unconditional render (essentially, you will find some minor exclusions). Unlike a due date, rate by the settlement otherwise listed property sales you simply cannot quote in the market which have a variety of regular standards including designers profile, LIM Account otherwise financing conditions. You only pay a deposit (always ten%) into the person attempting to sell the property the afternoon of your market. You now is actually the time or you might sagging the deposit.

When you’re currently pre accepted by way of one of many loan providers, we are going to manage to help you work through all financing criteria and then mark what you away from so you might be nearly 100% positive that once you bid from the market, the financial institution will provide everyone the mandatory loans and then make the purchase. Often the merely reputation that could be outstanding could be the valuation (we are going to explain ore less than).

Market times can taken send in the event that around seems to be a lot of great interest and so for individuals who wait until you find a property having market in advance getting the money approval arranged, it does mean that i don’t have a lot of time. The brand new public auction could be taken send and after that you dont actually have the opportunity to help you quote.

That have a great ten% put to invest at the time

When you pick at public auction, its an unconditional purchases and so on the installment loans online in Wyoming afternoon regarding the new auction, you pay a deposit in order to contain the assets. Constantly that’s an excellent ten% deposit.

By using KiwiSaver to support the purchase, just be sure to ensure that you have got your KiwiSaver out of the KiwiSaver supplier that is willing to feel used to pay the deposit. Often this will be tough having timings as is possible simply take 10 – 15 working days for your KiwiSaver to get taken and put in your solicitors account.

When possible, sometimes it is beneficial to keeps a back up accessibility to household members otherwise members of the family who can help purchase make payment on ten% deposit with money on a single day following if you get in order to settlement, their solicitor can program to own all of them repaid playing with most other loans associated with the payment.

Note: This is the exact same pool of cash we speak about in terms of extent you have got need set for the a property get

Due diligence, specifically valuations

The last thing to look at with auctions (any kind of your own deposit) is that you have to do all research just before brand new public auction time. Sets from builders account, meth evaluating, LIM Reports and making certain you can buy finance should performed until the public auction and there is very few indicates to leave out-of a profitable public auction quote after the facts.

This means performing this without even understanding if you will probably winnings within public auction. It does rating pricey so that you should be prepared. It is usually informed to dicuss into the solicitor just before auctions and having their advice on every due diligence.

A portion of the distinction when selecting in the auction that have below a great 20% deposit is the fact that lender will require you to receive a valuation done to the property you are attempting to purchase. Now you can get you to over until the public auction however it is a big costs (next to $1000) and so ideally you hold back until when you know you are likely to be able to find the domestic to accomplish this (we.elizabeth. pursuing the market).

If for example the valuation do have been in lower than everything possess claimed to own within auction, this isn’t impossible to beat but you need to be in a position to safer possibly so much more financing with the financial and come up with up the change otherwise you desire members of the family otherwise nearest and dearest available to current the difference between finance.

So, can it be done.

Yes, you can aquire at public auction that have less than good 20% put. Its quite harder and you ought to feel a great bit more organised having back-up arrangements, but it you can certainly do.

Reach out for the My Financial cluster and you can Greg, Emerald, Adam or Claire would love to take you step-by-step through the process, get you pre approved and help you buy at public auction.