What’s a housing-to-Long lasting Financing?

/images/2019/10/11/petal-cash-back-visa-card.png)

A housing-to-long lasting mortgage, also referred to as a good C2P mortgage, is a type of financing providing you with landowners flexible resource availability when strengthening a unique family. Present people may also fool around with a C2P loan to finance a beneficial restoration or house building work project. In the event the cashadvancecompass.com/personal-loans-ga/ build is complete, the loan harmony is actually folded otherwise converted into a vintage financial.

The good thing about structure-to-long lasting financing inside the Phoenix is because they were a few other loans – a houses mortgage and you may a mortgage. Consequently, there clearly was only one closing rates if the residence is depending, helping you save money. Although not, just one-product, single-loved ones house be eligible for a homes so you’re able to permanent mortgage.

Reasonable, Flexible Home loan Financial support

Versus most other capital options for house structure methods, C2P financing try a feasible selection for getting your ideal household in Phoenix. Of numerous home owners and aiming people inside the Arizona turn to this one of the freedom it’s.

Construction-to-long lasting fund are better than stay-alone construction finance since you can be blend the development and financial finance toward that. Stand-alone framework fund, at exactly the same time, leave you a single funding package, that will just protection the building will cost you. If the house is done, you are able to still need to apply for a vintage home loan.

Which have an effective C2P financing, you could potentially protected your interest although you buy house and construct your perfect house or apartment with only a 5% downpayment. Since majority of lenders lenders may demand a low deposit to possess C2P loans, specific loan providers request all the way to 20-30%.

How do Build-to-Permanent Money Really works?

For many of us seeking to get a housing loan, the initial and you may biggest difficulty are knowing what the procedure in fact involves. Even though it is very puzzling to numerous, securing construction funds is not actually distinct from traditional mortgages.

According to your own lot area, the latest tips can differ a bit from guidelines various other components. For landowners and you can home owners into the Phoenix, the process of protecting good C2P financing inside the Phoenix try outlined below:

Software Stage

Just be sure to pick an established builder and speak with a mortgage top-notch about the ideal resource possibilities. Very lenders tend to ask to see your construction plans and strengthening offer just before giving your loan.

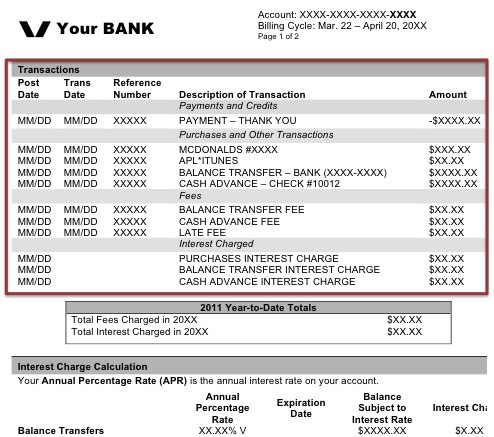

They’re going to comment your revenue, assets, expense, and credit card need. Essentially, need good credit so you’re able to safe an effective C2P financing in the Phoenix and also the following credit rating requirements:

- 95% LTV As much as $850K 720 FICO

- 90% LTV $850K so you can $1MM 720 FICO

- 85% LTV – $step one,000,001 to help you $step 1.5MM 740 FICO

The lender can also demand a property appraisal when you are starting a repair, that may plus make it possible to determine their home loan rates. Knowing and you can undertake the loan details, you could indication the borrowed funds documents and commence construction.

The building Stage

Inside the structure phase, the lending company usually launch a number of kinds of money on the builder since you advances as a result of more degree of your own framework.

- Disbursements and you can monitors. Their financial tend to agenda an examination of the really works carried out by the latest creator ahead of your bank disburses finance to help you refund for materials used and you can really works complete.

- Build Brings: Pursuing the review of your own really works complete, the newest creator draws occasionally about structure loan available with your bank. Most lenders fundamentally discharge money within dos-step three business days.

- Home loan repayments: Into the structure phase of one’s C2P loan, your financial tend to bill your monthly having notice, you pays interest-merely costs before project is done. This is calculated based on the amount of finance the fresh new lender disburses for every time and energy to the creator to own completed work.

You cannot make dominant payments toward loan amount up until build is done. And additionally, with respect to the location of your parcel, the lending company can get request that you purchase property insurance policies, eg a flooding premium, with your appeal percentage.

Since you accept into your new house, your design-to-permanent loan is converted to a long-term otherwise conventional financial. Because the that loan transformation will currently enter place for good construction-to-permanent loan, you will not need to shop for a unique financial. From here into, you pay a fixed rate focus to your home loan that may offer for as long as three decades, according to first terms of the loan.

Our team Can Counsel you on the right Mortgage Form of

We all know the home loan process might be daunting when around are many loans options to select from. Our very own Very-Motivated Vercellino cluster is ready and you will prepared to address any queries you’ve got throughout the framework-to-long lasting finance that assist you find whether it’s an educated financing individually.

You can always telephone call our Phoenix place of work within to talk to a mortgage professional whenever. Their mission would be to show you the kinds of mortgages available and you can tune in to your house ownership needs so they are able partners you with a customized mortgage alternative.