His latest loan commission are reasonable and much easier, therefore he’s blogs to go out of some thing how they is. Getty Images. Getty Photo

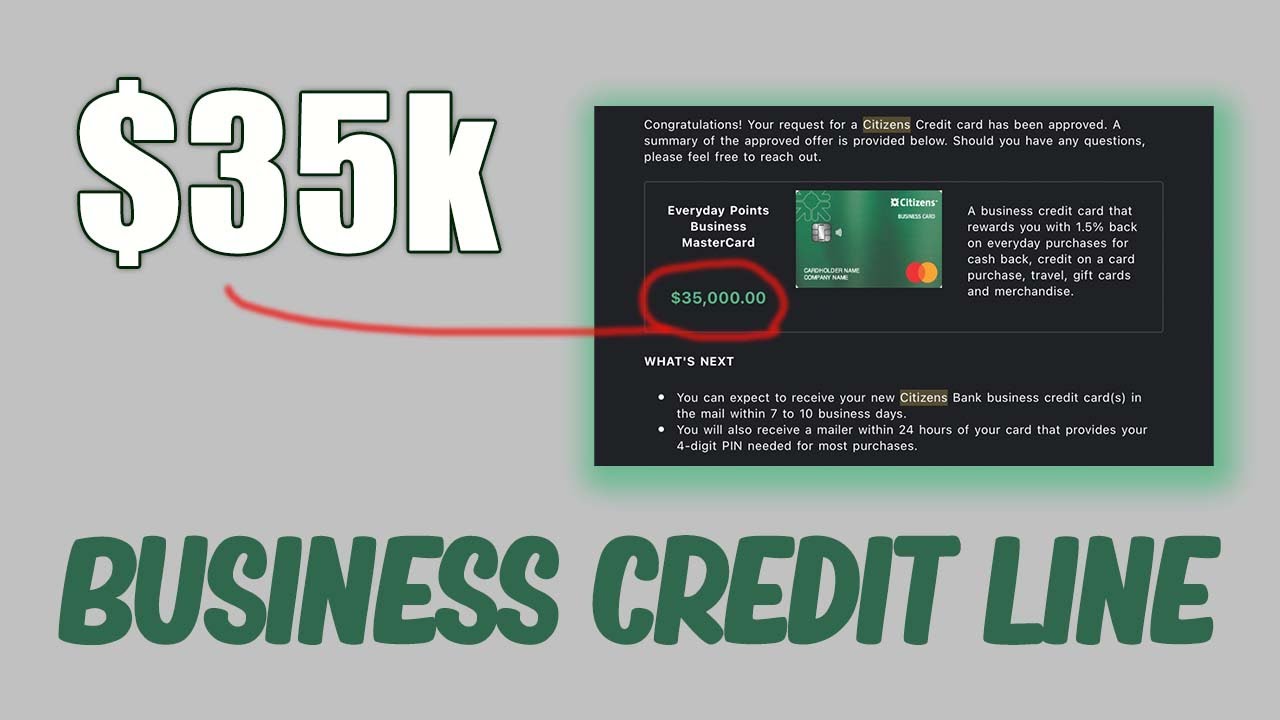

Beloved Liz: We lent $thirty-five,000 of my personal domestic security membership 24 months ago to cover yet another roof. Our house is purchased; there is no mortgage.

My wife thinks I should repay the bill, that is $31,000. This should do a significant gap in our liquid assets.

The current commission are affordable and much easier, so I am content to leave one thing the way they is actually. In the morning I missing some thing?

A great deal more guidance

- Asking Eric: Widowed artist desires show audio on his brand new love, however, their family unit members actually ready

- Dear Abby: As to why did husband post holiday cards so you can members of the family which let’s down throughout the daughter’s relationships?

- Miss Manners: Do i need to posting courtesy economic agent whom delivered provide out-of a cup along with his logo in it?

When you borrow secured on your own residence’s guarantee, you generally speaking play with possibly a home collateral personal line of credit or a home security loan. Household security money usually have fixed interest levels, fixed costs and you may an exact payback months, including ten otherwise 2 decades. House equity personal lines of credit be much more such as for instance credit cards: He’s got varying rates, and you will draw down and you may pay back your debts more flexibly.

However, HELOCs keeps a touch of a created-in the trap. Regarding initially draw period, often the earliest ten years, your commonly won’t need to pay down your debts. You are usually required to pay only attention. If this draw period finishes, you ought to begin making dominating payments towards the any the equilibrium, just what exactly your debt per month can shoot up significantly.

For this reason HELOCs are usually best utilized for expenditures that will be paid off apparently quickly. If you would like 10 years or even more to blow right back exactly what your debt, a fixed-rate household security financing is generally a far greater option. Certain lenders render a predetermined-price solution within the HELOCs, that’ll enables you to protected a steady price toward particular or all equilibrium and you can pay it back with repaired costs over the years.

No matter how brand of mortgage you may have, the attention you are spending probably exceeds what you are getting, immediately after income tax, on your own deals. Paying down good HELOC balance allows one tap you to definitely borrowing from the bank again when you look at the a crisis, if required https://paydayloanalabama.com/moody/. Paying down a predetermined-speed mortgage won’t take back borrowing instantly, however you can expect to redirect this new monthly installments into the coupons in order to rebuild their cushion. If that allows you to worried, you could potentially believe and come up with huge monthly payments to spend back the brand new mortgage at some point while maintaining the bulk of their deals unchanged.

Liz Weston, Specialized Monetary Coordinator, try an individual financing columnist having NerdWallet. Concerns can be provided for their particular in the 3940 Laurel Canyon, Zero. 238, Facility City, Ca 91604, or utilising the Contact form within asklizweston.

If you buy a product or service or sign up for an account as a consequence of an association on the our very own web site, we could possibly receive settlement. Making use of this site, your consent to our very own Representative Agreement and agree totally that the clicks, affairs, and private advice may be accumulated, registered, and/otherwise kept of the united states and you can social networking or any other 3rd-party couples in line with the Privacy.

- Their Confidentiality Choice

- | Associate Contract

- | Post Choices

Disclaimer

Usage of and you may/or registration toward people portion of the website comprises acceptance away from our Member Agreement, (up-to-date 8/1/2024) and you will acknowledgement your Privacy, along with your Privacy Choices and you will Legal rights (current step 1/1/2025).

2024 Improve Regional Mass media LLC. All the rights arranged (From the You). The information presented on this site may not be recreated, distributed, sent, cached if not used, except with the earlier composed permission of Improve Regional.