Re-finance rates commonly best for of several consumers already, having costs nevertheless far higher than historic downs inside pandemic. Although not, for folks who has just purchased a home and you can closed for the a rate anywhere between 7 and you may 8 per cent, you may get the opportunity to refinance to a lesser price inside 2025.

If you have owned your home for quite some time, you may possibly have more domestic guarantee built up today, specifically that have exactly how home values have increased. If you would like loans to do most other wants, such as for instance household remodeling, you might power that security which have a money-out re-finance.

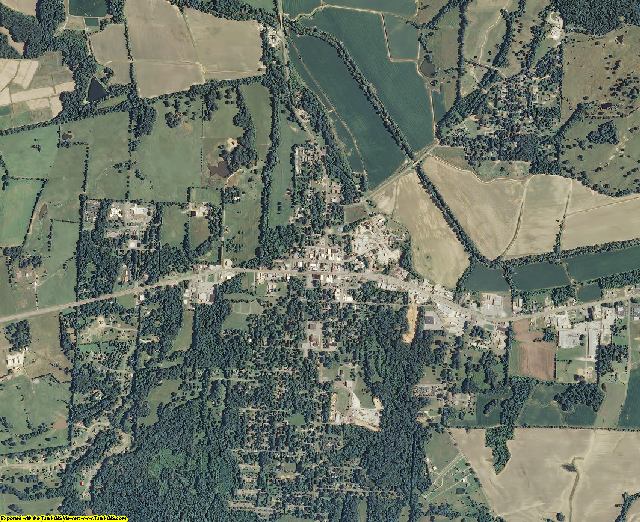

Oklahoma home loan speed fashion

Inspite of the Government Set-aside reducing new government fund rates 3 x consecutively, 30-year home loan pricing nationwide have grown, exceeding seven % at the beginning of 2025. When you find yourself home loan rates are hard so you can assume, many economists expect costs to stay in the six so you can eight % diversity for the rest of 2025, following a temporary spike more than 7 percent.

High financial cost and you can increasing home values always create cost a problem for almost all Oregon people. The new median house transformation speed within the Oklahoma was $230,000 when you look at the , upwards 7 percent as opposed to the year early in the day, according to ATTOM. Yet not, even with that increase, Oklahoma a property costs continue to be better less than national averages. This new federal median domestic rate is actually $406,100 at the time of , with regards to the Federal Association regarding Realtors.

National home loan pricing because of the mortgage kind of

- Get

- Refinance

How Bankrate’s prices is computed

- At once averages: We calculate day-after-day overnight price averages on the individuals affairs away from numerous loan providers. We gather such APRs immediately after close regarding providers, as well as mirror the last day’s prices according to a borrower with an effective 740 FICO credit history and a keen 80 percent financing-to-well worth (LTV) proportion to purchase a preexisting, single-relatives no. 1 quarters.

- Bankrate Screen (BRM) rate averages: Every week, i and gather APRs in the ten biggest financial institutions and you can thrifts for the ten of the most important You.S. avenues. For those averages, i guess a borrower having a 700 FICO credit rating (740 in the event that a non-compliant mortgage) and you can an enthusiastic 80 per cent mortgage-to-worthy of (LTV) proportion, one of other standards.

This new quickly and Bankrate Screen averages derive from zero present relationships otherwise automated money. Find out more about our very own rate averages, editorial advice and how we profit.

Financial statistics to have Oklahoma

Oklahoma’s seemingly discount off lifestyle are a stylish feature for new owners. It was ranked since the obtaining the 4th cheapest from lifestyle index total for the 3rd one-fourth regarding 2024, depending on the Missouri Financial Lookup and Pointers Cardio. When you are finding buying a home for the Oklahoma, below are a few statistics to learn:

- Cheapest areas, : Alfalfa, Harmon, Kiowa, Tillman

- Average family transformation speed, : $230,000

- Median down-payment, : $27,000

- Homeownership speed, Q4 2024: 67%

Financial choices into the Oklahoma

If you are intending purchasing a Illinois bank personal loans property inside Oklahoma and will need fund your purchase, check out mortgage solutions you can imagine:

- Oklahoma traditional mortgages: In order to qualify for a normal financial, you’ll need the very least credit score from 620 and you can an obligations-to-earnings (DTI) proportion of only about 45 percent. That have a downpayment out of less than 20 percent, you will need to shell out individual financial insurance rates (PMI), too.

- Oklahoma FHA fund: In the event the credit rating disqualifies you against a traditional mortgage, you’re able to get a loan insured of the Federal Casing Government (FHA). When you have an advance payment of at least 3.5 per cent, you could qualify for these types of mortgage with a cards score as low as 580.