Month-to-month Mortgage repayment

Your mortgage repayment having a great $333k home will be $dos,220. This is certainly based on a great 5% interest and you may an excellent 10% deposit ($33k). For example projected property taxes, possibility insurance, and financial insurance costs.

Income Necessary for a good 300k Financial

You need to make $111,009 annually to afford a beneficial 300k financial. We feet the cash you would like for the a beneficial 300k mortgage into a repayment that is 24% of one’s monthly earnings. To suit your needs, the month-to-month money can be about $nine,251.

You could be conventional or a good a bit more competitive. It is possible to alter which inside our how much cash home can i manage calculator.

Make Quiz

Use this fun quiz to find out simply how much domestic I can afford. It takes merely minutes and you’ll be able to opinion a personalized comparison at the bottom.

We will make sure you aren’t overextending your allowance. You will additionally provides a soft amount on your own bank account immediately after you order your house.

Try not to Overextend Your budget

Financial institutions and you may realtors earn more money after you get an even more high priced family. Usually, financial institutions often pre-accept your for as possible maybe manage. Out of the entrance, earlier traveling land, your finances would be extended towards maximum.

It is important to make certain you try more comfortable with your payment per month together with sum of money you should have kept for the your money when you get your family.

Compare Home loan Pricing

Be sure to compare mortgage cost before you apply having good mortgage loanparing step 3 loan providers can save you thousands of dollars in the first few years of the financial. You could potentially examine financial prices for the Bundle

You can see current home loan cost or find out how mortgage pricing today have trended over recent years on the Bundle. We display every single day mortgage pricing, styles, and you will discount points for 15 year and 30 season mortgage affairs.

- Your credit rating is an important part of the mortgage techniques. When you have a high credit history, you have a much better chance of providing a great approved More hints. Lenders are far more safe giving you home financing commission one to is actually a more impressive part of your own month-to-month income.

- Homeowners association fees (HOA fees) can impact your property to order power. If you choose a property who’s got highest association costs, it means you will have to choose a reduced cost home to in order to decrease the dominating and attract percentage adequate to render space with the HOA dues.

- The almost every other financial obligation payments can affect your house budget. When you have lower (otherwise no) other loan money you can afford going a small large on your own homeloan payment. When you yourself have large monthly premiums to many other finance eg car money, student education loans, otherwise handmade cards, you will have to back down your own month-to-month homeloan payment a small to make sure you have the funds to expend all your expenses.

Not so long ago, you needed seriously to build a 20% advance payment to afford a home. Today, there are many different financial items that will let you make a beneficial far shorter down payment. Here you will find the down payment standards to have prominent mortgage activities.

- Traditional financing need good 5% advance payment. Particular first time homebuyer software allow it to be 3% off money. Several instances are Home In a position and Home You’ll.

- FHA finance require a 3.5% down payment. In order to qualify for a keen FHA financing, the house you are to find have to be your primary quarters.

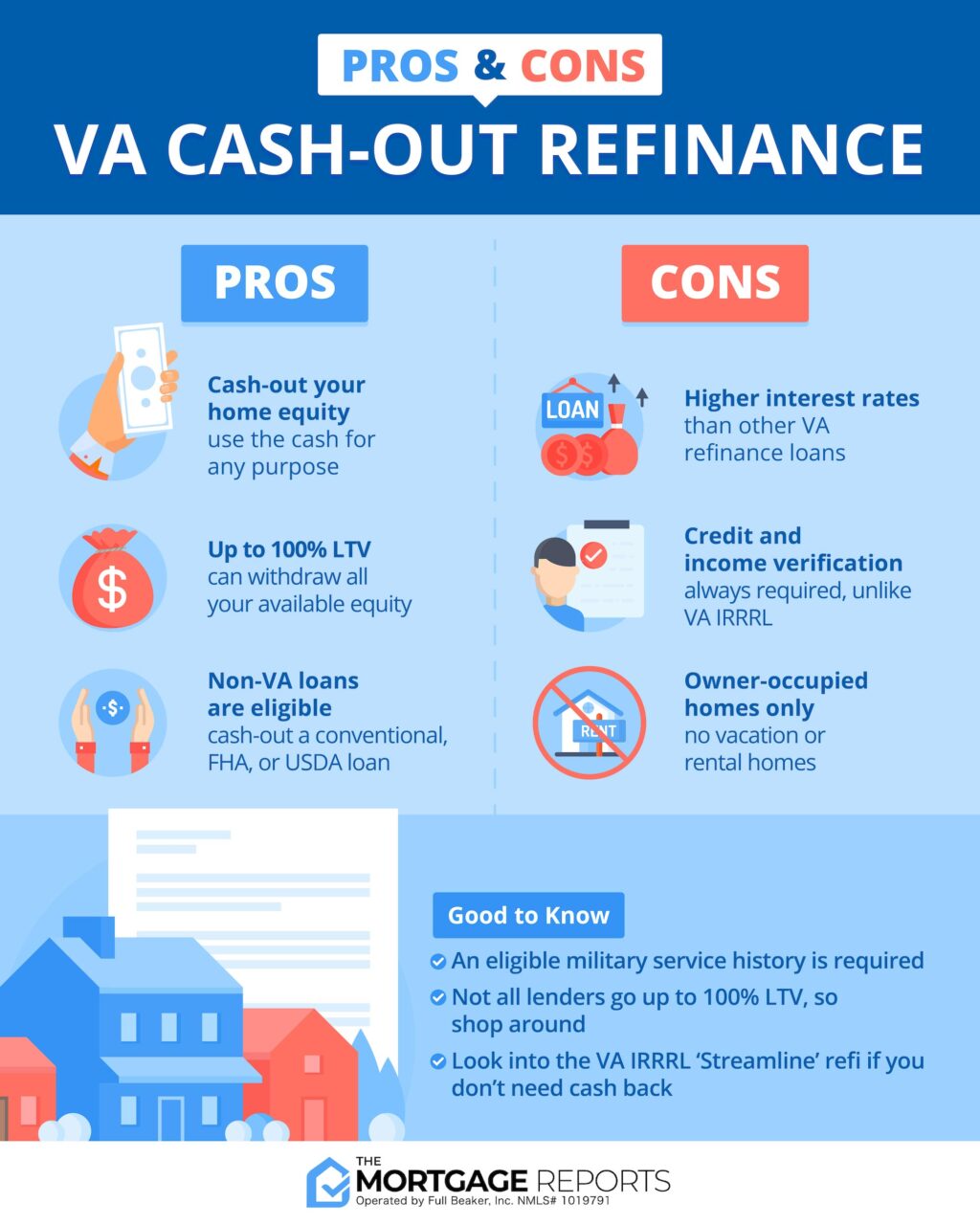

- Virtual assistant loans want a great 0% downpayment. Productive and you may resigned armed forces teams is eligible for good Va mortgage.

- USDA fund want a great 0% advance payment. These are mortgage loans available inside the outlying aspects of the new nation.

Exactly what are the tips to buying property?

- Play around which includes home loan calculators. Strat to get comfortable with all expenses associated with purchasing a house. Most people are surprised once they observe much a lot more property fees and you will home insurance adds to its commission monthly.

- Look at the credit score. Of several financial institutions will today show you your credit rating 100% free. You may want to play with an app including borrowing karma.