You want to enable it to be easier for you. That’s why we have married with AmeriCU Mortgage. They offer almost three decades out of business feel performing you to definitely-of-a-type financial alternatives.

Be it very first house otherwise the 5th, one minute home for the Florida or a great cabin right up northern, relocate in a position or an effective fixer higher, you can rely on AmeriCU to take care of your.

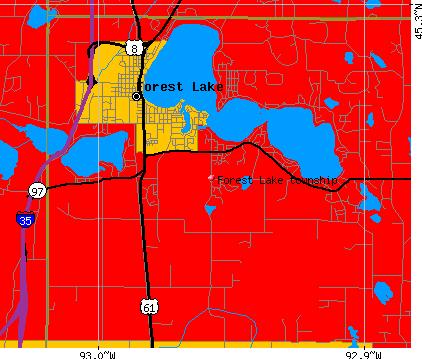

USDA financing try mortgage loans to have house during the qualified outlying portion and you will is actually supported by the usa Service off Agriculture

The best burden to help you homeownership today is saving sufficient money to own home financing advance payment. AmeriCU Financial offers advance payment otherwise closing prices recommendations up so you can $2,500 getting earnings-licensed individuals.^

Aggressive pricing. Great customer support. Various financial circumstances. AmeriCU can get you in your fantasy household, effortless peasy lemon squeezy.

- Antique

- FHA

- Va

- USDA

- Buy Renovation

- Jumbo

An effective Va loan try a home loan that is supported by the fresh new Agency away from Experts Activities getting pros, effective army personnel and you can military partners whom qualify

A conventional financing is considered the most common home loan choice for professionals looking to purchase otherwise re-finance a property. They are not secured otherwise covered by the one government agency and adhere to the borrowed funds limitations put because of the Government Housing Loans Government (FHFA).

A keen FHA mortgage is an interest rate provided from the federally qualified loan providers and you will supported by the new Federal Houses Management. Designed for lower-to-modest earnings consumers who’re not able to create a massive down payment- he could be typically significantly more flexible during the borrowing from the bank and you can earnings requirements than simply traditional finance.

USDA money are directed at low-to-moderate earnings group seeking to finance a property. They give you low interest rates with no deposit is necessary.

Players get pick from 203(k) Restricted & Basic plus HomeStyle factors when they prefer Res in order to accommodate big in addition to lesser repair will set you back, providing you the flexibleness to-do a whole lot more with your brand new home. Consulting with a mortgage professional is the greatest treatment for determine the program most effective for you! More resources for Restoration, click the link.

Good jumbo mortgage was a mortgage to have a price one to is higher than conforming money constraints put by the Federal Houses Money Department (FHFA). Such fund are created to money luxury property together with functions in very competitive areas.

A beneficial Virtual assistant financing was a mortgage which is supported by the latest Agencies out-of Veterans Factors to own experts, energetic army professionals and army partners who qualify

A conventional mortgage is among the most well-known home loan selection for people thinking of buying or re-finance a home. They aren’t protected or covered from the people regulators institution and you can conform to the loan restrictions lay by the Government Casing Funds Management (FHFA).

An FHA financing is actually a mortgage approved of the federally licensed lenders and you may backed by the Federal Housing Management. Available for lower-to-moderate money borrowers who are not able to build a large off payment- they are typically even more flexible for the credit and you can income standards than simply traditional loans.

USDA loans are targeted at lower-to-moderate income household trying to loans a home. They give low interest without down-payment will become necessary.

Users could possibly get select 203(k) Limited & Practical plus HomeStyle points when they like Res to help you fit biggest as well as minor renovation can cost you, providing you with the flexibleness to complete a lot more together with installment loans for bad credit in Georgia your new house. Consulting with a mortgage elite is the better answer to dictate the program right for you! More resources for Repair, follow this link.

Good jumbo mortgage are a mortgage to possess a price you to definitely exceeds conforming funds constraints place from the Federal Homes Fund Department (FHFA). Such funds are created to money luxury belongings in addition to attributes in the highly aggressive real estate markets.

Financial attributes provided by AmeriCU Mortgage ^Down payment/closure rates guidance system is only obtainable in conjunction having particular conventional compliant investment programs, to your purchase deals for primary houses. Downpayment/closure prices guidance quantity derive from Town Median Earnings and you will most other eligibility conditions in fact it is applied just like the a credit inside the mortgage closure procedure. Provide is almost certainly not used for money, and no alter will be presented whether your discount number exceeds will cost you otherwise owed. Promote isnt transferable. Bring cannot be used retroactively. AmeriCU supplies the ability to terminate so it offer any moment. Homebuyer counseling try a requirement to sign up this choice. There can be a beneficial $99 counseling percentage that’s paid back because of the debtor.