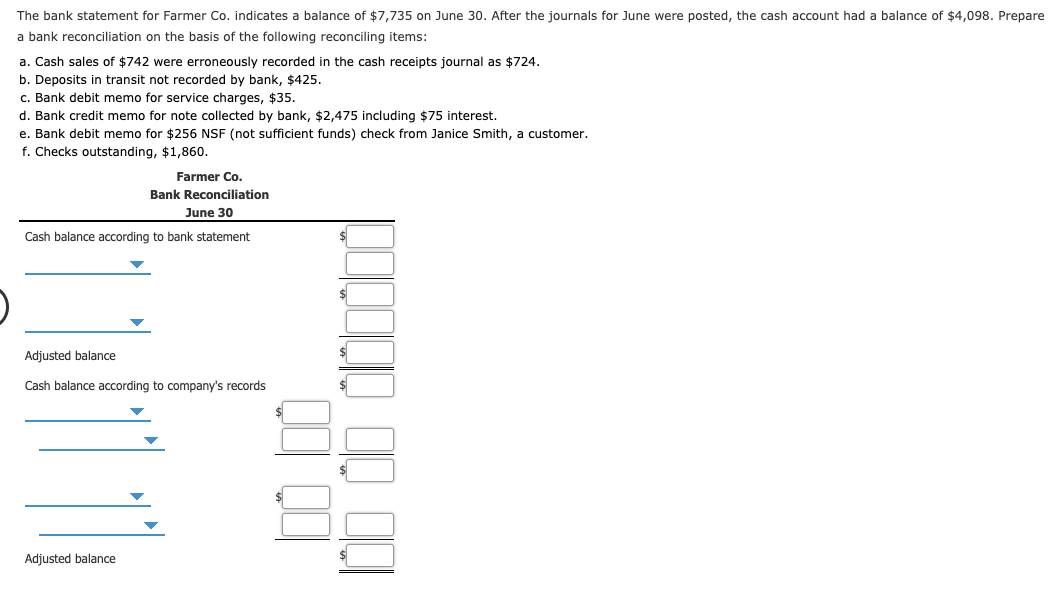

What things to Realize about Evaluation and you will Assessment Standards With FHA Money

Following this FHA promoting guide, might place on your own able to offer your residence to help you a purchaser playing with a keen FHA home loan.

Whenever promoting a house, it’s important to learn how to help make your household eligible to possess buyers looking to have fun with an enthusiastic FHA loan.

It allows those with solid borrowing to purchase house having a beneficial brief down-payment, only 3.5%, it is therefore clear as to the reasons many home buyers choose the FHA alternative.

Which have up to 30% out of homebuyers using FHA funds, there is certainly a high probability you could get an offer of an enthusiastic FHA client for your home.

If you’d like to believe that offer, try to has a property that suits the needs of FHA that’s strict and it has derailed many home conversion process one to appeared to be an or finest match.

Not all domestic qualifies for a keen FHA home loan, so it’s necessary to understand the laws and regulations. What merchant really wants to undertake a deal out-of a purchaser having fun with FHA financial support merely to get a hold of a critical roadblock between of one’s purchase?

You want your own real estate professional understand how FHA investment works. There is no part of accepting an offer off a purchaser which have an enthusiastic FHA financial in the event the home will not meet the requirements.

What’s an enthusiastic FHA Check and Assessment?

Which have a standard household get, a lending company requires a property assessment are complete to make sure there is certainly adequate collateral throughout the assets.

When a prospective consumer uses a keen FHA financing, the newest U.S. Agency out of Housing and you may Metropolitan Development (HUD) means an assessment and you can inspection of your own house’s status.

Below FHA assessment direction, the fresh new inspection is carried out by a HUD-recognized FHA appraiser. The property have to be from inside the fairly good shape to successfully pass the fresh new FHA review standards.

Here cannot be really serious problems that may impede safe and compliment lifestyle requirements. Letter structural problems in the home might be introduce.

Brand new FHA appraiser will determine whether the assets fits the standards established of the FHA. They will certainly take note of the property’s condition, noting any warning flag towards the a keen loan places Granada FHA-acknowledged setting.

A keen FHA Appraiser Offers The significance as well as the Condition

The latest appraiser may also give a genuine estate assessment such as they perform with any house. They make use of the most readily useful a house comps than the subject possessions.

Once taking a look at all of the similar conversion process investigation, they are going to provide the lender will a keen appraised really worth. This new FHA assessment schedule is similar to any other kind out of loan.

FHA Attempting to sell Guide to an FHA-Acknowledged Client

Because the FHA will likely be rigorous from the the domestic criteria, the company is fairly reasonable with what it needs. If you intend to market a home, you could potentially most likely meet the requirements with a bit of effort and you can money.

Sooner work might be beneficial providing access to 30% of the property buyers in today’s market.

Just what Wouldn’t Admission an FHA Inspection?

It’s wise to resolve big dilemmas earliest to be certain your citation the brand new FHA check standards. The FHA has assessment direction you to appraisers need to pursue whenever examining house.

For folks who sell to an FHA customer, you must improve tall affairs like a leaking rooftop, structural situations, direct decorate, mold infestations, or other significant troubles.

Repairing big situations prior to checklist for sale will become necessary if you need to get the best price for your home regarding a keen FHA consumer and other buyer so you may as well dedicate whenever you are looking for attracting an educated consumers.