An alternative perk out of FHA financing is the fact there aren’t any money restrictions. That’s good news while reduced towards advance payment financing but earn more compared to the average money for the venue, as many down payment guidance (DPA) apps are just available to people to make less than the area median money (AMI).To qualify for a keen FHA loan, you’re not required to was in fact utilized for a specific amount of time – but you’ll need tell you pay stubs covering the last 30 days. Continue lendo “Dollars supplies (for large-DTI otherwise lowest-credit-score applicants)”

Ask anyone to co-sign your home financing

A USDA mortgage try a home loan program backed by the fresh U.S. Service out-of Agriculture. It caters to lowest and you will average-income homeowners within the appointed rural elements. The funds hats are different by the condition and you may household size. Although not, most you to-to-four-individual homes inside outlying counties renders as much as $100K annually whilst still being be eligible for this financing.

These types of loans try glamorous as they will need no down payment and you can include aggressive rates of interest. But not, to be eligible for this financing, your FICO score should be firmly inside reasonable (580 – 669) otherwise close-primary (620 – 659) diversity. If the credit score suits the bill and you are clearly prepared to get a house within the an outlying area, this might be probably one of the most affordable an effective way to feel a good resident.

Va financing

- Ideal for: Veterans, surviving partners from pros, and you will productive services players

- Minimum credit score: Zero program minimal, but some lenders want 620+

- Just how to implement: Rating a certification of Eligibility (COE) and apply for a loan supported by the Va. Continue lendo “Ask anyone to co-sign your home financing”

Other types of Money spent Fund and exactly how Ours Evaluate

Perhaps one of the most preferred investment property loan options is for single-family rental functions that have step 1 so you can cuatro gadgets. These types of services will be kept permanently, developing the fresh spine of your financial support portfolio, or even be marketed whenever market conditions change and you may you’d like to pick an alternate investment. You can expect a considerably simplified certification procedure as compared to conventional funds, enabling people home trader to cultivate monetary balances as a result of actual property.

Accommodations

Vacation leasing properties in the glamorous traffic portion can be make strong dollars circulate, making them an incredibly profitable investment solution. The authoritative funding financing to own travel qualities is actually underwritten according to short-term rents and therefore are good for care loan places Vina about-functioning investors, as a consequence of its smooth underwriting processes. Advertisers can take out such finance under a corporate organization and you may include their individual property if you are expanding the funding portfolios.

DSCR Financing

A loans-Services Exposure Proportion (DSCR) financing is ideal for commercial assets using the approval conditions. As opposed to antique money, hence rely on private economic pointers like your debt-to-earnings ratio, an effective DSCR financing decides qualifications based on the property’s online working money than the their month-to-month mortgage repayments. Continue lendo “Other types of Money spent Fund and exactly how Ours Evaluate”

Where to look for financing origination charges

Mia Taylor provides more than 20 years of experience making reference to travelling, feminine and money, using, and personal cash. This lady has contributed articles so you’re able to different top national publicationsm together with Travel + Entertainment, TravelAge Western, AAA Northeast, Bankrate, You.S. Information and you can World Declaration, L.An effective. Mothers Mag, and you will TravelPulse.

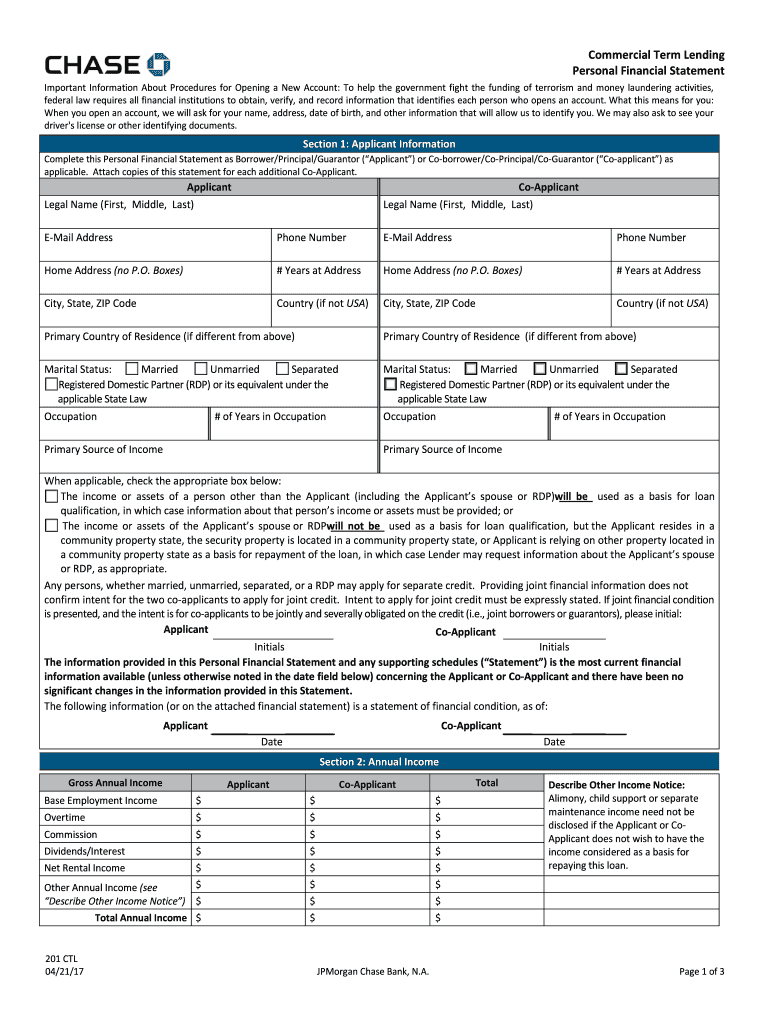

For many potential home buyers, acquiring a home loan is a crucial part of the house to shop for procedure. And obtaining prices regarding multiple loan providers to be sure to hold the best mortgage to the welfare price you can easily is nearly as important as finding an alternate family.

When you find yourself home loan shopping, it’s important to remember that there are a selection off costs tacked onto your home loan of the loan providers which can be called origination costs. These fees shelter the price of putting some mortgage, and by law, loan providers have to promote an initial estimate regarding how much these extra fees could be.

Most common origination fees

The variety of origination charges can vary somewhat from bank so you can bank, and many loan providers are able to use some other titles to have particular costs. Continue lendo “Where to look for financing origination charges”

* Requires dos moments, zero borrowing remove

Welcome to the newest definitive help guide to find out about individual currency loan providers for real home. This guide is intended having educated a home buyers and individuals who’re merely starting. Our objective is to try to help you construct your a home expenses operation by giving your that have a comprehensive academic resource that covers things personal loan providers.

What exactly is a private money-lender?

Individual money lenders is low-financial loan providers that give all types of loans in order to enterprises and you will customers. Private lenders can range out-of rich individuals highest organizations.

Individual Money Loan providers Near Myself

Whilst it might be an advantage to work with an exclusive financial on the local sector, you can find large national individual loan providers which might be almost certainly effective during the their industry and worth establishing a romance with. Below are a few the best way to track down personal financial:

?? Community — inquire somebody you-know-who it strongly recommend. Guarantee that he’s direct experience working with the lender. ????? Continue lendo “* Requires dos moments, zero borrowing remove”

Student loan Costs Restart Just after step 3-Year Pause

Of a lot was in fact optimistic at the idea off President Joe Biden’s $eight hundred billion-dollar forgiveness plan, however, a divided Finest Legal prohibited those individuals work arguing the government requisite Congress’ endorsement ahead of undertaking a costly system.

- Copy a relationship to that it video on the clipboard

Report difficulty

- Financial support & Shipments

- Transcript

Joining Us Today With additional For the Regional Perception, All of our Nevertheless It absolutely was Merely 2020 Graduate Out of National LOUIS College or university.

She is Today A program Help And you can Strategies Planner At the Group Will KAGAN To school TARA DIA Triumph System Summation, Chicago And JONATHAN LOPEZ, Good LINCOLNWOOD Realtor Having CENTURY.

>> There is lots To express I would like to Start by Just what Keeps Your Sense And Feel Become Like with College loans?

I am not Wanting to Go after Bin Anything Return to School Discover And how We Battled Creating 3 Perform.

Receptive iFrame

Therefore we Pay My personal Money And Trying to Alive Regarding A park To locate To Moms and dads Live A consistent Therefore it is Its Difficult, However it is A thing that It is Future You.

First And i Enjoys Prevent And you will Attempting to Go after My Degree Care Since the I would like to Go back to My Moms and dads Basic.

That is Particular This new Hardships From However, I have had Understanding Deal Having But that is Which is Some thing That’s Always been Throughout the Straight back Off My Lead.

>> Person Stressed Being required to Balance The average Student loan Loans To possess ILLINOIS States Almost $38,000 Nearly 55% Of your Way more 1 million Borrowers Into the ILLINOIS Under the Decades Out of twenty-five Level. Continue lendo “Student loan Costs Restart Just after step 3-Year Pause”

For framework money, Acceleration Affairs are paid just after very first attracting

Offered to eligible teams which sign up for a different Virgin Currency Prize Myself Financial

Wedding Products, currently 30,000 Acceleration Activities, is actually paid back on every step 3 season anniversary of your own settlement day given complete borrowings are greater than $fifty,000 (online of every balance kept from inside the a connected counterbalance facility). Affairs are merely paid after no matter what level of separated borrowings a customers enjoys with our team as well as should be a continued Award Me Mortgage customer into the several months.

It is possible to submit an application for a rate secure if you are paying an initial fee computed during the 0.15% of your own repaired amount borrowed until the financing time or productive go out of one’s associated repaired price.

Offer is available to family members/ friends of Virgin Australia Group employees. Offer is only available to applications made by directly calling 13 81 51 or by visiting that’s not available if a credit card applicatoin is established using a broker. Users need to mention whom the fresh Acceleration staff can be element of the application process. Give closes .

Qualifications requirements: a) All of the employees out-of Lender out of Queensland Ltd together with teams of its wholly had subsidiaries, Manager Managers and you can team utilized by Owner Managers

Offer off $100 elizabeth-Provide credit is obtainable so you can eligible customers exactly who buy a new Virgin Family and you can/or Information rules. Continue lendo “For framework money, Acceleration Affairs are paid just after very first attracting”

Getting A good Virtual assistant Financing Which have A good 580 Credit score

The way to get A beneficial Va Financing With A great 580 Credit score

The fresh new Virtual assistant mortgage work with produces home ownership possible for Veterans, productive services professionals and enduring partners. Instead of old-fashioned loans, The fresh new Company out of Experts Products has no need for a particular credit rating. You still would not want with poor credit given that Va loan providers tend to still look at your credit rating and may also refute your considering big borrowing occurrences on the early in the day. It is vital to talk about your credit score with a beneficial Va financing expert in the 800-720-0250.

So, and also poor credit otherwise a minimal credit rating does not mean you’ll be refuted a beneficial Va mortgage, increased rating may help keep interest off. This may allow for cheaper money along the longevity of the borrowed funds. You may want to take pleasure in buying a home without having to build a down payment. Continue lendo “Getting A good Virtual assistant Financing Which have A good 580 Credit score”