The main focus is much more extreme on your power to pay off the fresh new mortgage based on steady earnings, in place of exclusively on credit history.

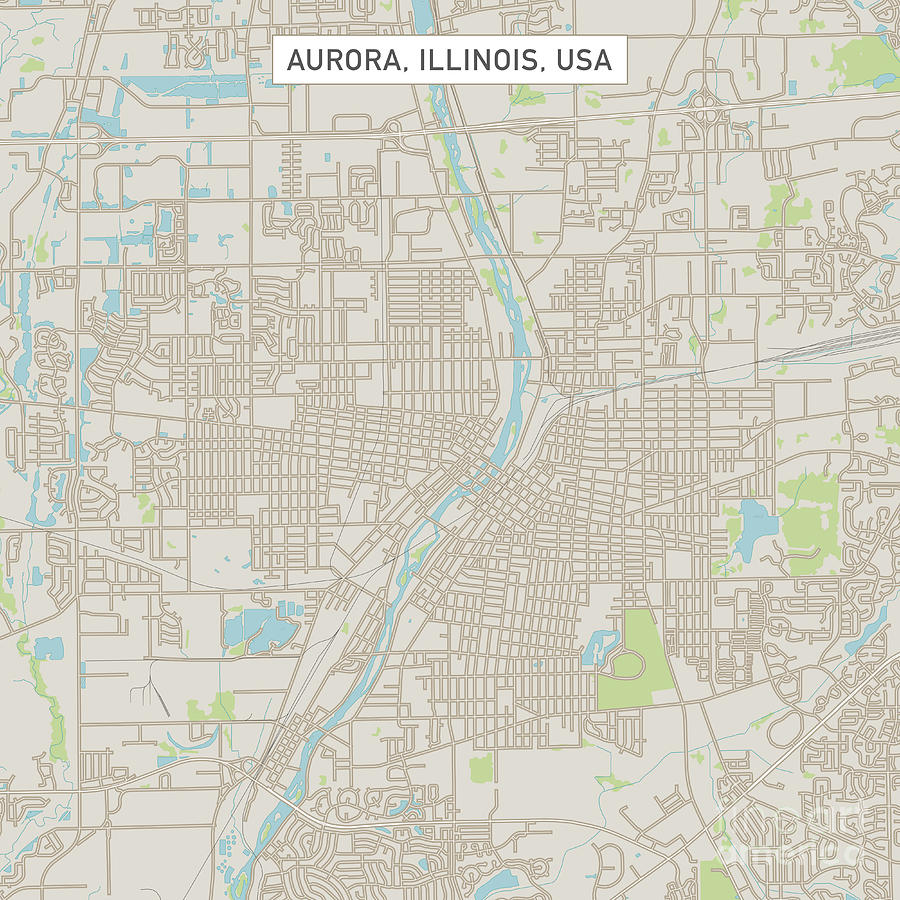

Property Location Standards

USDA finance are hyper-particular of possessions place. The home https://clickcashadvance.com/installment-loans-tn you may be targeting need to attend good USDA appointed outlying or residential district city so you’re able to qualify for these types of financial support, underscoring new crucial role location takes on.

Facts if or not a home falls in this USDA recommendations is critical. On line USDA Assets Eligibility’ products is going to be an invaluable money inside guaranteeing if for example the dream household fits the fresh outlying otherwise suburban requirements place by the USDA.

The application Techniques

Getting into the journey to your fantasy family starts with skills the whole process of obtaining a USDA loan. This involves searching for an excellent USDA-approved bank, finishing the loan app, and swinging to the closing the mortgage.

So you can simplify their USDA application for the loan, we provide one step-by-step guide. It can help your right from choosing your own financial, due to trying to get the loan and on to finally closing the offer, making the right path to rural homeownership less complicated.

Wanting a good USDA-Approved Financial

The initial channel in your USDA mortgage trip are identifying an recognized lender. To tackle a crucial role, it act as new gateway into USDA Financial, ensuring all the guidelines try found.

To start, examine the menu of USDA-approved loan providers. This reveals a network off establishments authorized to administer such money, paving your path to outlying homeownership.

Doing the borrowed funds App

Let us tread the trail regarding homeownership to the USDA Loan application. It is a vital part of unlocking brand new secrets to your perfect outlying domestic.

The fresh USDA application for the loan will be your strategy so you can outlying homeownership. Continue lendo “But not, in the event your credit score is sub-standard, USDA financing are known for its flexibility”