How does a personal loan Apply to Your credit score?

Signature loans has good multifaceted impact on your credit rating, determined by things such as for instance credit score, missed repayments, debt consolidating, borrowing mix, credit application, and you may debt load. Payment out-of unsecured loans promptly enhances a person’s credit history. Daily remaining percentage due dates builds a good credit score, showing a responsible and you can reliable borrower.

Not paying consumer loan installment payments adversely has an effect on the credit rating. People late payments that go unpaid-for over thirty day period adversely change the credit history and you will standing. Keeping a good credit score needs and then make towards-day money.

Getting a consumer loan to pay off debts facilitate the financing score in several ways. Move high-attract credit card debt towards the a personal loan membership decreases the borrowing from the bank application ratio. They minimizes borrowing from the bank use, enhances the credit history, and appears positively towards credit file.

Diversifying the financing mix is yet another way an unsecured loan affects the financing rating. The credit combine try increased by the and additionally payment borrowing, like a personal bank loan, and you can revolving credit, like playing cards. Lenders could see a diverse borrowing merge absolutely whilst suggests you to different kinds of borrowing from the bank is managed sensibly.

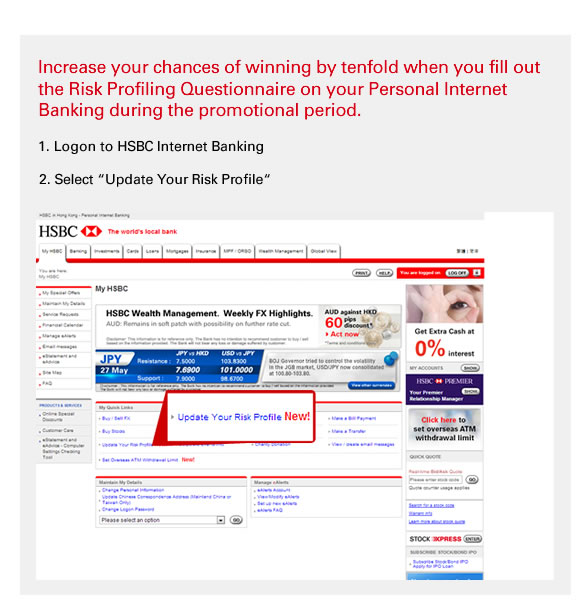

The non-public loan application processes very first causes a short-term fall off from the credit history of the lender’s difficult query. The newest temporary drop disappears with time, particularly if the the fresh new credit is actually appropriately addressed.

Increasing the loans weight using a consumer loan raises the overall debt weight, that’s thought whenever determining the credit rating. Continue lendo “How does a personal loan Apply to Your credit score?”