On this page

- What’s an escape method?

- Mortgage brokers to have many years pensioners – is it feasible?

- Government-focus on plans

- Open guarantee on your existing home

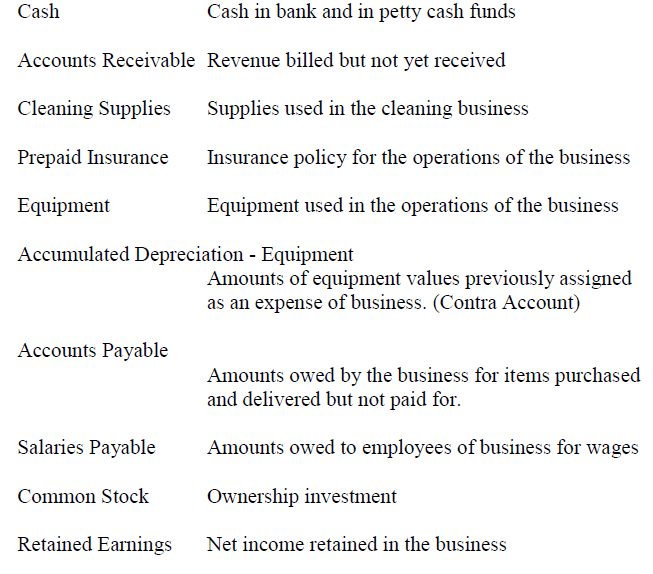

- Most loan providers need to come across a leave approach we.age. how you will pay with the mortgage once you change 50. Of many loan providers supply a hard cover out-of qualified users as much as 80 yrs old.

- This your retirement might possibly be examined just like the money, however, cannot be enough.

- If you currently individual a house outright and you are trying purchase a special, some home equity techniques such as the House Equity Availableness Plan, house security money and you can contrary mortgage loans you certainly will matter towards earnings requirements.

- There are even everyday pension requirements and you will stamp duty exemptions to have those people trying to downsize their property.

- Its imperative your talk to a financial agent otherwise tax top-notch to find out how you can finance a home purchase in your advancing years, specifically without hurting your retirement qualification.

For the usual property era, state your late twenties otherwise very early 30s, your affect the bank together with your put, payslips, and a beneficial savings records, and you’re usually on the merry method. Considering really mortgage terms and conditions was twenty-five or three decades this is going to make they easy for more youthful individuals to pay it back totally before retirement. Continue lendo “Mortgage brokers for the elderly is actually you’ll be able to, you simply might need to talk about some solution alternatives or possess an escape approach”