Given that an army retiree and a financial planner, I have seen first hand the way the novel challenges faced from the army society enhance changes in the latest cost savings and you may You.S. bodies coverage.

Towards the Sept. 18, the fresh new Government Reserve observed more substantial-than-questioned, 50-basis-area (0.5%) interest rate slashed, although of numerous get regard this using a general financial contact, I would like to be sure to consider just how which has an effect on army family, in particular.

Away from deployments to frequent movements and you may all things in anywhere between, the new armed forces feel cannot always myself satisfy the civil feel. Here’s how a choice including the Fed’s is also bubble owing to the private funds of your armed forces people, impacting from savings accounts so you’re able to home loan rates.

All the way down Borrowing Can cost you

One of the primary points that pops into the mind which have a Fed speed slashed is how it may decrease the cost of credit. Many army household believe in finance getting trucks, homes and even to pay for unexpected expenditures throughout a long-term change-of-station (PCS) flow otherwise implementation. That it speed clipped you will definitely promote some desired relief, nonetheless it might not be short otherwise as the impactful given that monetary statements have you believe. Remember, the latest feds you should never lay (or slash) the interest rates you and I shell out myself: This reduce signifies a speeds cut in terms of exactly what finance companies shell out to help you borrow money from other banking companies, plus it impacts whatever you pay available on the market.

- Mortgages: Of many army family, plus mine, have tried Va finance when selecting a house. Such fund render high benefits, such zero downpayment, zero personal home loan insurance coverage and you will aggressive rates of interest. That have interest rates trending straight down, new monthly mortgage payments towards the new financing could be more glamorous. According to my discussions with several borrowers, it may be a while very early — the existing financing carry a considerably all the way down interest — to share refinancing, but if you actually have home financing, refinancing you are going to render a tiny move place in your funds. For these looking to buy, its a way to protected straight down costs and also make homeownership less expensive or even to rating a bit more fuck to suit your dollar.

- Auto loans: I do believe I can securely declare that People in america eg the car, while the military neighborhood can even take “like” and you can escalate you to to help you “like.” Whatever the case, down rates mean minimal automobile financing, which could make an improvement if you are searching to purchase a different sort of vehicle. This will be possibly the right time to refer the possibility monetary benefits of riding your car much time not in the duration of your loan.

- Playing cards: If you’re holding borrowing-cards personal debt, a speed slashed could help ease the latest economic load a while. Of a lot military family members have confidence in credit to pay for unexpected costs, whether it’s during time-to-date life, a deployment otherwise transitioning out from the services. Straight down prices towards handmade cards indicate reduced focus mounting up and you can a heightened part of the “more-than-the-minimum percentage” supposed with the the primary harmony.

Down Yields on the Offers and Investments

When you’re minimal borrowing from the bank is great, the fresh disadvantage is that a speeds reduce also can indicate straight down yields towards coupons and you may old-fashioned financial investments. Since the an economic coordinator, I have always prioritized building a very good crisis finance and you can planning tomorrow. Unfortunately, down interest rates produces you to definitely a while more difficult and less fulfilling.

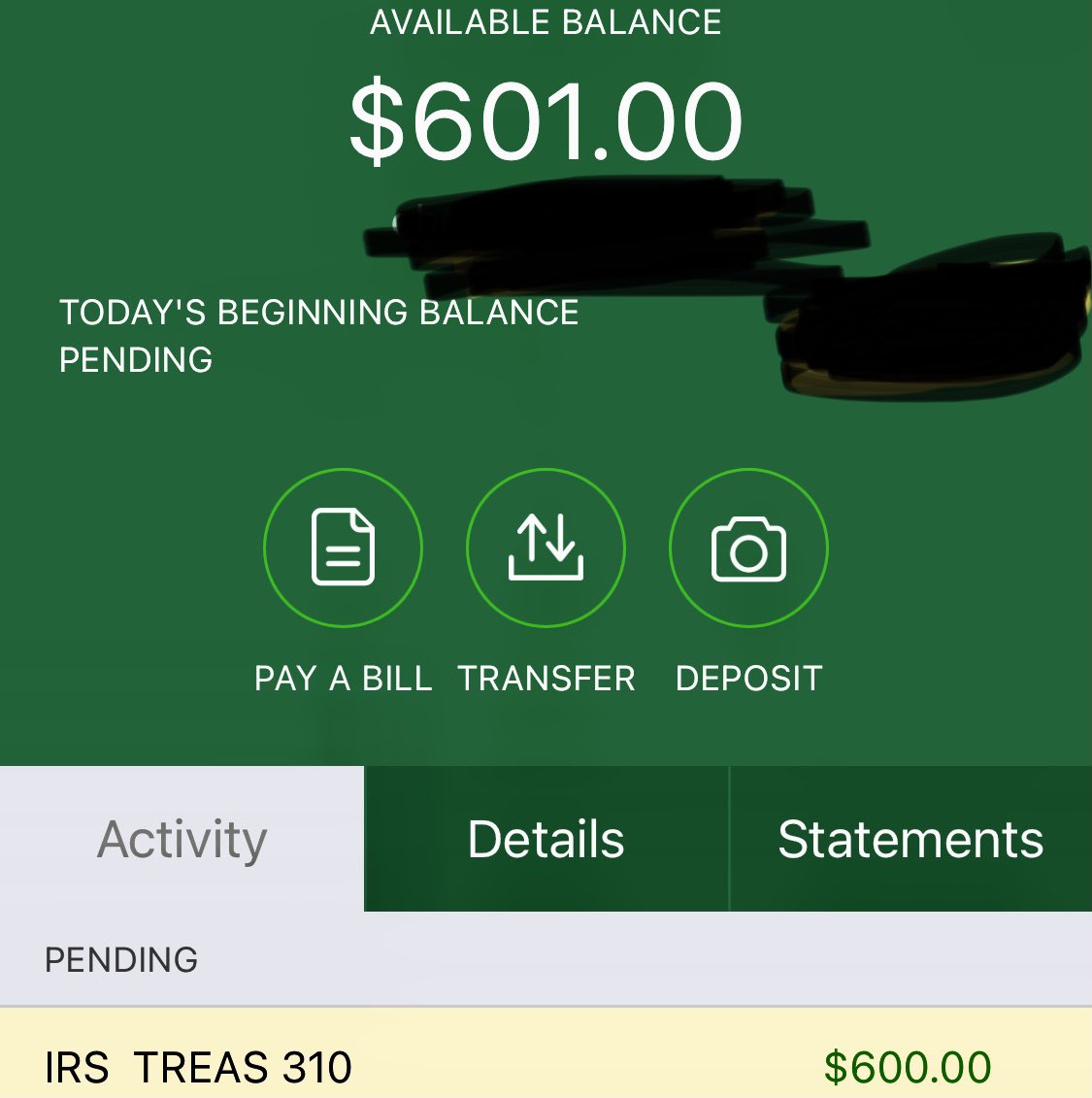

- Coupons levels: Each of us understand how vital it is to possess an effective well-filled emergency financing, especially because of the suspicion away from military life. However with lower rates, the bucks sitting for the coupons membership earns even less focus. This might allow it to be a little more challenging to enhance one financing on “address level.” Aren’t getting as well involved inside considering. One of the keys is that you feel the disaster deals readily available when it’s needed. The brand new Given clipped will make all of it more important to search for an educated readily available rate on the offers.

- Senior years profile: For these invested in new Thrift Savings Bundle (TSP) or other senior years otherwise capital profile, brand new Fed’s speed slash will not directly connect with inventory funds show, but it can be dictate business decisions. All the way down cost often force the market right up, which can be good news for these which have higher-exposure investments. Yet not, when you’re more old-fashioned and you will worried about money assets, like other retired people is actually, all the way down prices are going to be a mixed handbag, riding bond pricing highest, but attract money and money streams all the way down.

Housing market

Army families move more often than civilians, sometimes all long time, according to instructions away from Uncle sam. You to fact keeps always forced me to mindful with regards to armed forces household and you can owning a home. Down interest levels could affect each other investing on housing market, for example whenever:

- To shop for a house: Whenever you are on the market to shop for, lower mortgage prices try a big work with. They indicate cheaper funds and lower monthly installments. If biggest line item within our resources shrinks, which is a positive. Lower rates helps make this new dream of homeownership even more obtainable, specifically for young families.

- Attempting to sell property: On the other hand, if you need to offer a property, you might face improved battle since anybody else attempt to employ off straight down pricing, as well. Far more request you are going to speed up the latest attempting to sell procedure, which is a pleasant topic while https://availableloan.net/payday-loans-wv rushing against the clock to help you proceed to a special responsibility station and get away from the choice of experiencing two domestic money. Time try everything you for army household, and you can declining rates of interest could help lose stress during the an already disorderly Personal computers.

Inflationary Challenges

That concern You will find with people rate cut is the potential because of it in order to reignite inflation. In the event that rising prices registers, it will erode the to invest in electricity of armed forces income. It generally does not hunt long since i fled (or enjoys we?) the issues on this subject front.

Conclusions

This new Fed’s recent 50-basis-section rates reduce gift ideas one another potential and you will pressures. Straight down credit can cost you may bring recovery, particularly that have mortgage loans and you will fund, but reduced efficiency to your coupons and the possibility of rising prices indicate we need to stand aware as we display screen the economic bundle. Army family members is durable and you will resourceful, however, existence informed and you may adjusting so you’re able to alter like these is vital to keeping monetary stability.