One step-by-action self-help guide to our home equity financing process

It really works much like most other mortgages: You can easily evaluate has the benefit of, favor a lender, implement, and supply data eg spend stubs and you may lender statements. The lending company often comment the job and order an assessment. Shortly after acceptance, you are able to indication brand new closing documents, afford the initial fees, and found your hard earned money.

Of many homeowners prefer a home guarantee loan more than refinancing whilst cashes away collateral as opposed to replacement their established home loan. While wanting to know ways to get a house collateral mortgage, we have found the book.

What’s property security mortgage?

A property security financing is a kind of financing product which allows home owners so you can borrow secured on the newest equity they’ve got built up for the their homes.

Domestic guarantee financing performs much like top mortgages. Once qualifying to the financing centered on your credit score, money, and the number of guarantee in your home, the lender provides a lump sum of cash. You might be up coming forced to pay off so it amount, and appeal, for the fixed monthly installments more than a predetermined several months (the borrowed funds conditions) https://simplycashadvance.net/installment-loans-ia/.

The amount you might always use try a portion of your home’s appraised worthy of without any matter you will still owe on your own home loan. Which complete establishes a credit limit to suit your financing.

It is very important observe that because you make mortgage money, you’re not simply expenses mortgage appeal; you are along with repaying the main amount borrowed. This build differs from focus-simply commission formations, where consumers spend notice within the 1st mortgage title then pay-off the principal in a lump sum.

Whenever you are domestic equity finance provide tall financial resources to own something particularly renovations otherwise paying off high-interest loans, nonetheless they come with threats. The best ‘s the risk of property foreclosure in the event that mortgage payments aren’t made. For this reason, it is critical for people to carefully thought their capability and also make monthly installments prior to taking toward a home collateral mortgage.

Your residence is not just a location to real time; it is also a potential supply of financial autonomy. But learning how to get a house guarantee loan can seem challenging in the beginning. Don’t let that prevent your! Here, i demystify our home collateral mortgage process.

1: Determine how far cash you would like

The initial of your trick steps to obtain a home security financing is actually determining simply how much you prefer. In place of a property collateral personal line of credit (HELOC), which enables you to definitely tap their collateral as needed over the years, property guarantee loan need one use a particular mortgage number initial. Calculate what kind of cash you desire before applying for a financial loan, just like the matter your use has an effect on the entire rates.

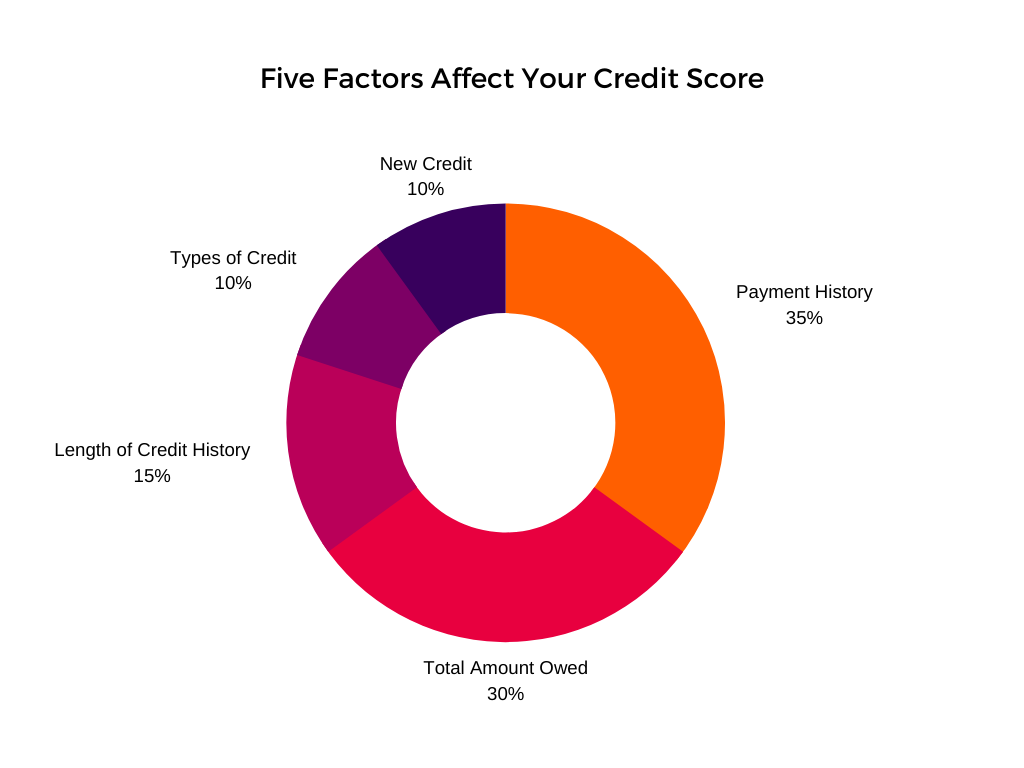

Your credit rating matters when trying to get a house equity loan. You’ll be able to basically score a lower life expectancy rate of interest and better conditions when the your rating is actually 700 otherwise significantly more than. The minimum score necessary to be considered is normally 620.

To check on your credit rating at no cost, inquire along with your financial or financial or sign in their credit cards membership (many credit card issuers give totally free fico scores). Only observe that totally free score may be more than what a good mortgage lender will see. To possess an even more real matter, you can aquire your credit score right from Experian, TransUnion, Equifax, otherwise FICO.

In case the score is gloomier than desired, just be sure to alter your credit prior to starting the house collateral financing approval procedure.

You could potentially improve your borrowing from the bank by paying their debts on time, not beginning people the fresh accounts otherwise credit lines, spending their numbers owed in full in the place of the minimum harmony, and you may fixing one discrepancies you will find on the three free borrowing from the bank account. Keepin constantly your borrowing need lower than 31% of total limit helps maintain the rating match.