The guy plus didn’t know the way difficult it could be to save up the regards to the brand new bargain, given that he didn’t see how much cash functions the house create you would like. There’s absolutely no requirement you to definitely a home inspector look at the house in advance of a binding agreement-for-action agreement was finalized. When Harbour told your he wanted to rating insurance, according to him, the insurance coverage organization come sending your complications with our home you to definitely he failed to have any idea resided-one file the guy demonstrated me, eg, advised your that his rake board, which is some timber close his eaves, is actually indicating break down.

And you can next, Satter said, most of these businesses are aggressively focusing on neighborhoods where people battle with credit on account of early in the day predatory financing methods, such as those one fueled new subprime-mortgage crisis

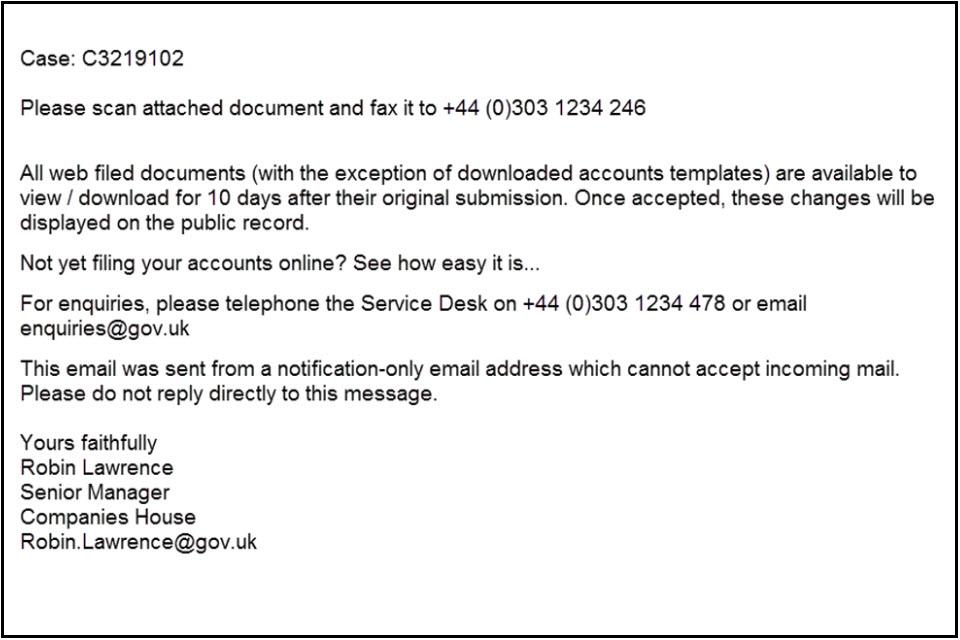

It chart, within the Court Assistance grievance, suggests the latest racial composition of the places where Harbour qualities try situated in you to definitely Atlanta county. (Atlanta Court Support Community)

There’s nothing inherently incorrect which have package-for-action arrangements, claims Satter, whose dad, Mark Satter, aided organize Chicago people contrary to the routine throughout the 1950s. Will still be possible for suppliers who are not banks to finance characteristics within the a reasonable way, she said. A san francisco bay area initiate-upwards entitled Divvy, including, are research a rental-to-individual model inside Ohio and you can Georgia that gives perform-getting consumers specific security yourself, even though they default towards the repayments. But there are 2 factors these types of price-for-deed plans take a look such unfair, Satter told you. Basic, the brand new belongings a large number of these businesses pick come into terrible condition-many was actually empty for many years in advance of being ordered, in place of the brand new belongings offered for bargain to own deed about 1950s, which was actually abandoned of the light residents fleeing so you can brand new suburbs. Fixer-uppers allow even more difficult having do-end up being customers in order to satisfy all of the regards to their contracts, just like the house you want a great deal work.

The fresh new credit uck, enabling financial institutions supply subprime finance and other financial products so you can people who or even might not have accessibility mortgage brokers

In certain ways, this new intensity of package-for-action services inside the Ebony areas are a medical outgrowth off how it happened for the housing boom and bust. Usually, these products billed exorbitantly higher interest rates and you may focused African People in america. One study discovered that ranging from 2004 and you can 2007, African Americans was indeed 105 percent probably be than white consumers to enjoys highest-pricing mortgages to possess home commands, regardless if controlling having credit score or other exposure activities. When all of these anybody missing their homes, the banks took all of them over. Those who did not sell at public auction-commonly those in predominantly African american areas where people who have money don’t have to go-wound up regarding collection away from Federal national mortgage association, which in fact had covered the borrowed funds loan. (Talking about therefore-titled REO, or real-house owned belongings, due to the fact lender possessed all of them immediately https://availableloan.net/loans/check-cashing-near-me/ after failing continually to sell all of them from the a foreclosures auction.) Fannie mae up coming given this type of home up on low prices to help you traders just who planned to have them, including Harbour.

But Courtroom Aid alleges one to Harbour’s exposure in the Atlanta’s Dark colored areas is over coincidence. By the choosing to merely purchase belongings away from Federal national mortgage association, the new suit says, Harbour wound up with land in the elements that experienced the largest number of foreclosures, exactly what are the same communities focused by subprime-mortgage brokers-teams out-of colour. Even the Federal national mortgage association house Harbour purchased was in fact into the distinctly African American neighborhoods, the fresh suit alleges. The average racial constitution of the census tracts into the Fulton and you can DeKalb areas, where Harbour purchased, try more than 86 % Dark colored. Most other consumers in identical counties you to purchased Federal national mortgage association REO features bought in census tracts which were 71 percent African american, the fresh suit states. Harbour also targeted the products it makes from the African People in the us, the suit argues. They did not industry its deal-for-deed arrangements inside newspapers, to your broadcast, or on television from inside the Atlanta, the latest match says. Alternatively, Harbour create cues in Dark colored areas and you will offered recommendation bonuses, a habit and therefore, the new lawsuit alleges, required it absolutely was mostly African People in america which heard of Harbour’s give.