The us Agency off Property and you can Metropolitan Development (HUD) offers a good amount of guidance applications to own mortgage loans. These software are created to help those who face different systems of challenges whenever wanting to purchase a property. Section 184 was good HUD program designed to provide unique mortgage loan assist with people in specific Local Western/Native indian and you will Alaskan people. Formally known as Indian Financial Guarantee system, fund made not as much as this program are known as an effective 184 Loan.

As to the reasons Was Point 184 Fund Composed?

Area 184 is made because of the Construction and Neighborhood Innovation Operate off 1992 to deal with the possible lack of mortgages to have native somebody. Western Indians and people in Alaskan people manage unique demands which make homeownership hard. Particularly, the newest residential property by itself that Indigenous anyone live on is also expose an excellent difficulty, as much of these residential property is held during the a rely on – both an excellent tribal believe or allocated (individual) faith. By-law, places stored within the faith having a group can’t be mortgaged.

Property stored into the good tribal believe should be designated since the a good leasehold estate, then approved therefore of the Agency out-of Indian Facts (BIA) and HUD. Despite private property, hence doesn’t have to track down approval getting a beneficial leasehold estate, a mortgage app on that property has to be accepted because of the BIA and you may HUD. These problems tends to make getting an intricate, tricky path to homeownership to possess Indigenous people who need to individual property.

The new Indian Home loan Be certain that program was made specifically to help render private resource as a result of https://cashadvancecompass.com/loans/ivf-loans/ Point 184 loans – mortgage loans which have good conditions which might be only for people in types of tribes all over the country, as well as Indian native and Alaskan Indigenous parents, members of certain Alaska Communities, People, or Tribally Appointed Housing Organizations. From this program, the federal government aims to strengthen the worth and you may economic wellbeing out of Local assets and you may Local organizations.

Benefits associated with a section 184 Loan

Area 184 Money bring several advantages more than many other antique versions regarding mortgage loans. Accredited readers can use getting a section 184 loan simply by handling playing financing establishments, such as for instance Financial Maxims Financial. It subsequently work on the new Agency regarding Indian Items towards the handling the reasons off hired tribal home, aiming to improve techniques simpler and much easier. Since homes factors are addressed, the lending company submits the mortgage to own approval to HUD.

- Low-down payment

- Low interest

- Incorporated financing make certain fee

- Guidelines underwriting – meaning a custom made, outlined comment procedure in place of submission files to a computer you to definitely instantly produces approvals otherwise denials based strictly on number

- Loan providers who’re coached and you will knowledgeable about variety of challenges Native some one deal with after they need certainly to getting property owners

- Security facing predatory loan providers which could make the most of these individuals

A different sort of benefit of Area 184 finance is the fact its mission isn’t minimal exclusively to purchasing a special household. Without a doubt, this type of funds are often used to get a preexisting family, nonetheless they can also be used to construct another domestic, and for the rehabilitation away from another type of otherwise current house. Capable additionally be accustomed refinance an existing financial under so much more favorable lending terms and conditions.

Certificates for an effective HUD 184 Financing

Eligibility to own a great 184 financing demands users as members of certain federally accepted tribes. Not all the tribes be involved in new 184 mortgage program, and there are specific certification that have to be satisfied in order to get one of these loans. However the very first foundation for certification is actually owned by a qualified and you can participating group.

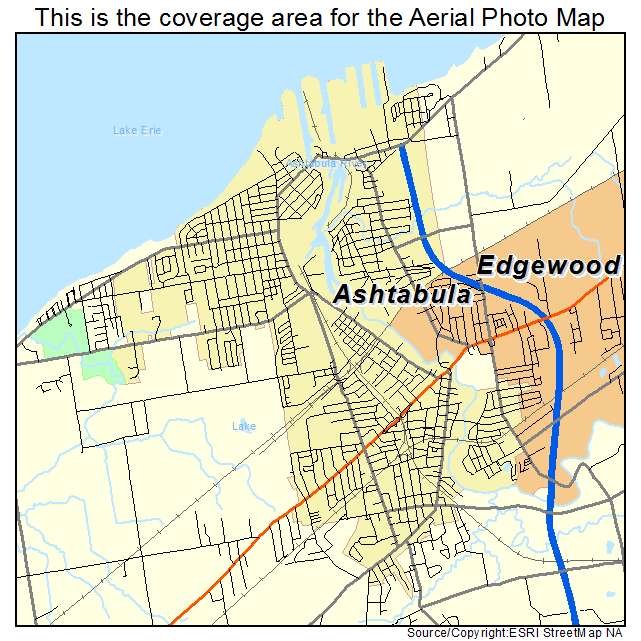

Information eligibility should be challenging, so if you’re unsure for individuals who qualify, a lender who participates in the getting Part 184 loans might help you realize even in the event you are qualified and give an explanation for particulars of the application for you. Such as for instance, experienced lenders know that the application form really does are some areas of belongings which aren’t part of tribal trusts. Next, you can find says where land in all of the county is approved, other says in which land in simply particular counties qualify, or other claims where there isn’t any qualified home anyway. This is why dealing with a lender who’s experience with Section 184 mortgages is important.

While part of a qualified tribe together with home we would like to purchase, build, or loans to have rehab is on qualified belongings, that’s a great first rung on the ladder. But there are numerous other factors to look at before applying because of it and other variety of mortgage:

- Have you got a constant source of income?

- Do you pay for their portion of the downpayment? (always dos.25%)

- Could you manage settlement costs?

The fresh Tribal Leadership Manual toward Homeownership may also be a useful investment for these given a great 184 Loan. That it file is sold with extremely important information, history, and you will guidance, and what kinds of loans tends to be designed for Indigenous individuals.

Taking a section 184 loan will likely be a complex processes. If you are a member of a native group and you will consider you happen to be entitled to a paragraph 184 financing, contact a dependable bank who couples in these types of fund to begin with brand new qualifying techniques.