Today I exposed to a representative (A customers representative, apparently). I happened to be expecting to mention rescuing right up a genuine off percentage, and you will beginning new search for a property a bit the following year.

Alternatively, she was most thrilled for us. All the she know try we generated below 70k together with no down-payment conserved. She thinks she will get you to the a home inside six days, instead of 24 months such as for instance I had believe.

She led us to a loan provider and wishes me to come across if we can get pre-approved to own a great “special” home loan which is :

- 100% Financed

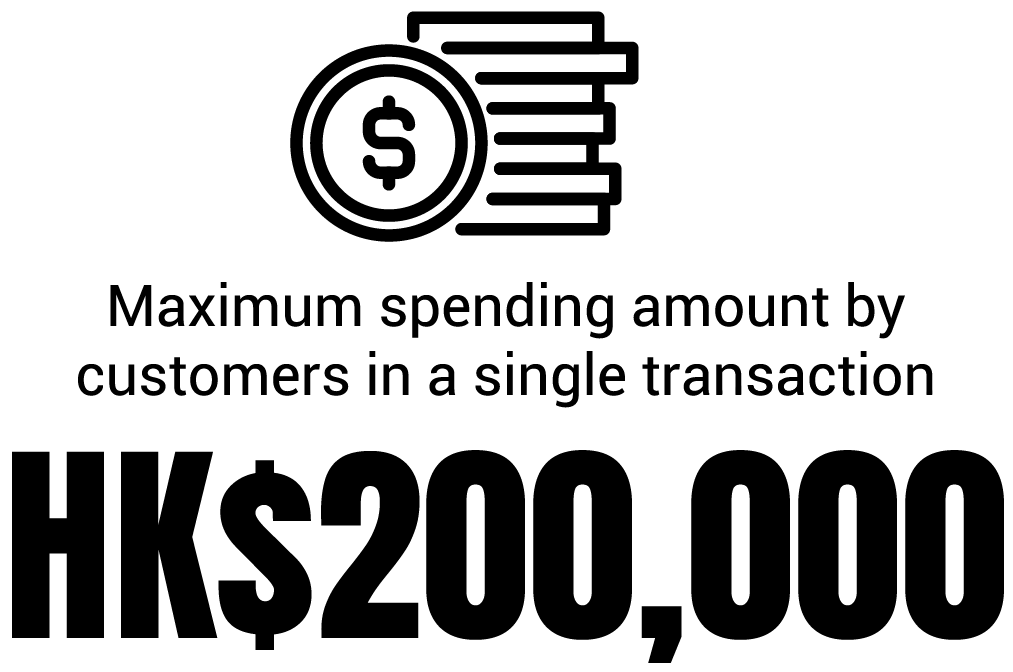

- Around $2 hundred,000

- Zero PMI

- Having Earliest-Date Home buyers merely

- To own People which have Lowest to Moderate Money

I became beneath the impact you to FHA money was indeed my personal simply choice, however, so it looks too-good to be true. I’ll arranged an ending up in the financial institution, but have a feeling these are typically trying lay me personally up with some form of predatory mortgage.

How can i determine if providing that it loan is within my welfare? I am aware to look out for high rates or strange commission fees, but is here something that they you will slip in towards the contract which i will most likely not notice?

- mortgage

- first-time-home-consumer

dos Solutions 2

It is very important point out that there are a big diversity off (legitimate) houses software in america which are not well known, and you will and therefore both give (totally genuine) subsidies or keeps which can be believe it or not attractive. Will such applications try sponsored courtesy government apps otherwise grants, which offer loan providers some freedom regarding composing fund one or even would not be you are able to. Sometimes these programs are run because of the county or state apps, which explains why they are tiny from inside the extent, variable in how it works, and you will relatively unknown. Arguably, FHA, USDA, and Virtual assistant money are definitely the best houses programs in the the us, however, you will find will others inside the certain markets. To me, it may sound such as the financing you may be are known might possibly be one among them apps.

The market industry having funds try motivated with the conclusion in the exposure. A great lender’s financing choices in addition to their underwriting laws and regulations are fundamentally the translation out of exposure towards dollars. In the event the a lender chooses not to ever bring a particular equipment so you’re able to a particular customer, it’s because performing this would-be also risky. Hence, an application that actually works by the offsetting chance which have profit specific way enables lenders giving finance that they if not wouldn’t generate.

Should i be skeptical off Basic-Go out Owning a home Apps?

That is where unique programs have playing. Generally, these software are designed to incent specific places of the inhabitants into the to buy land. This is followed because of subsidizing the financial institution to possess creating men and women funds. installment loans El Paso no credit check The cash which comes because of these programs fundamentally allows the lending company to help you counterbalance risk that might normally feel associated with a certain loan to possess a certain individual. Discover a dizzying selection of indicates such apps seem to be achieved (often the financial institution cannot support the loan – the us government do. Possibly this new grant program privately adds dollars to the mortgage because a great pseudo-advance payment. Often the latest offer system actually adds bucks to the bank and this effectively will act as a pad on rate of interest. Sometimes the lender gets entry to a swimming pool of money once the a reserve facing loss. Etc).

As an instance, my borrowing partnership has just got an application in which they obtained a beneficial offer to remind a segment of inhabitants to order property, whom if you don’t would not were capable. The us government is actually shopping for enhancing the quantity of residents inside a particular section of your own people, but definitely failed to have to manage loans that were additional high-risk, and so the grant was applied to assist encourage an effective designs (saving) also to offset chance. Users wanted to ticket an everyday application for the loan processes, then they needed seriously to contribute a fixed deposit total a unique savings account monthly for a-year, to display that they have been serious from the saving on the home, and you may were able to funds currency each month having home ownership. If they performed you to, this new give system paired its overall deposit after the year as a way off inflating its deposit. The newest money were and authored in the less-than-typical interest and the borrowing connection received an attraction subsidy one counterbalance the write off. Some of the people who took part in this option managed simply to walk towards the an alternate home with high security and a beneficial sensible interest on the a loan they may pay for, whereas they would not have been capable of getting an affordable financing (or people at all) without the program’s help. It’s a winnings-win-win: the client gets assist without having to be installed a dangerous problem, the credit connection becomes yet another buyers, and also the state government gets a happy and you can secure citizen investing fees.