Prepayments

Q: Must i make a limited prepayment back at my opposite home loan account? A: Really reverse mortgage loans commonly enable a limited prepayment with the opposite mortgage account instead of penalty. NRMLA highly recommends that you discuss the limited prepayment alternatives hence may be online beneath the regards to the loan contract with your reverse home loan servicer.

A: Per opposite financial equipment provides particular sequences to possess implementing limited prepayments. Particularly, for people who currently have an excellent HECM reverse financial, in that case your costs try used on the adopting the order: first to that element of your loan balance symbolizing home loan insurance premiums, furthermore to that section of the loan balance symbolizing servicing fees, thirdly https://elitecashadvance.com/personal-loans-nm/regina/ compared to that element of your loan balance symbolizing appeal charge, finally compared to that part of the loan harmony representing dominating enhances. NRMLA highly recommends which you confirm along with your financing servicer this new way that their limited prepayments would-be used on your own specific account.

Attract charge as well as your income taxes

Q: Must i deduct the eye prices for tax objectives? A: Desire costs are only able to become deducted shortly after the individuals attract costs keeps started repaid. As long as you haven’t produced one payments into reverse financial, you’ll be precluded of deducting people focus costs for money income tax intentions. If you have produced partial prepayments, then you definitely need to be hoping that the prepayments was used into the attract costs (discover section seven, Prepayments).

NRMLA strongly suggests which you speak with an income tax elite the recommendations regarding the deductibility people notice charge regarding your reverse mortgage membership.

Resolve Recommendations

Q: What exactly is a repair Rider? A: Into the look for circumstances, there is a requirement this 1 repairs on the property end up being finished which means that your assets matches the desired credit conditions. In the event that doing such as for instance repairs is actually a disorder of one’s financing closure, then chances are you were to has actually signed good Repair Driver toward loan contract. That it Rider can be your arrangement accomplish the mandatory fixes in this enough time physique detailed in this Fix Driver. The Resolve Driver is recognized as being most conditions on mortgage contract.

NOTE: NRMLA strongly encourages that have all of the called for fixes finished because of the due date produced in their Repair Rider. Failure to do their fixes by big date stipulated on your Fix Rider try a default Of Mortgage Agreement and certainly will result in the suspension system of all of the repayments to you personally and can even produce your loan is entitled owed and you may payable.

Q: What is actually a Resolve Set aside? A: The fresh new Repair Arranged ‘s the percentage of your available funds which can be to be utilized entirely toward conclusion of your own necessary repairs. So it arranged isnt element of the loan balance up to and that go out the latest fund are generally paid.

Q: Often monitors be asked to guarantee the mandatory repairs had been finished? A: Sure. The loan servicer commonly strategy to get the repair work examined to be able to be sure the desired repairs were accomplished. It could be it is possible to to arrange meantime inspections in order for partial repair achievement costs can be produced by the financing servicer.

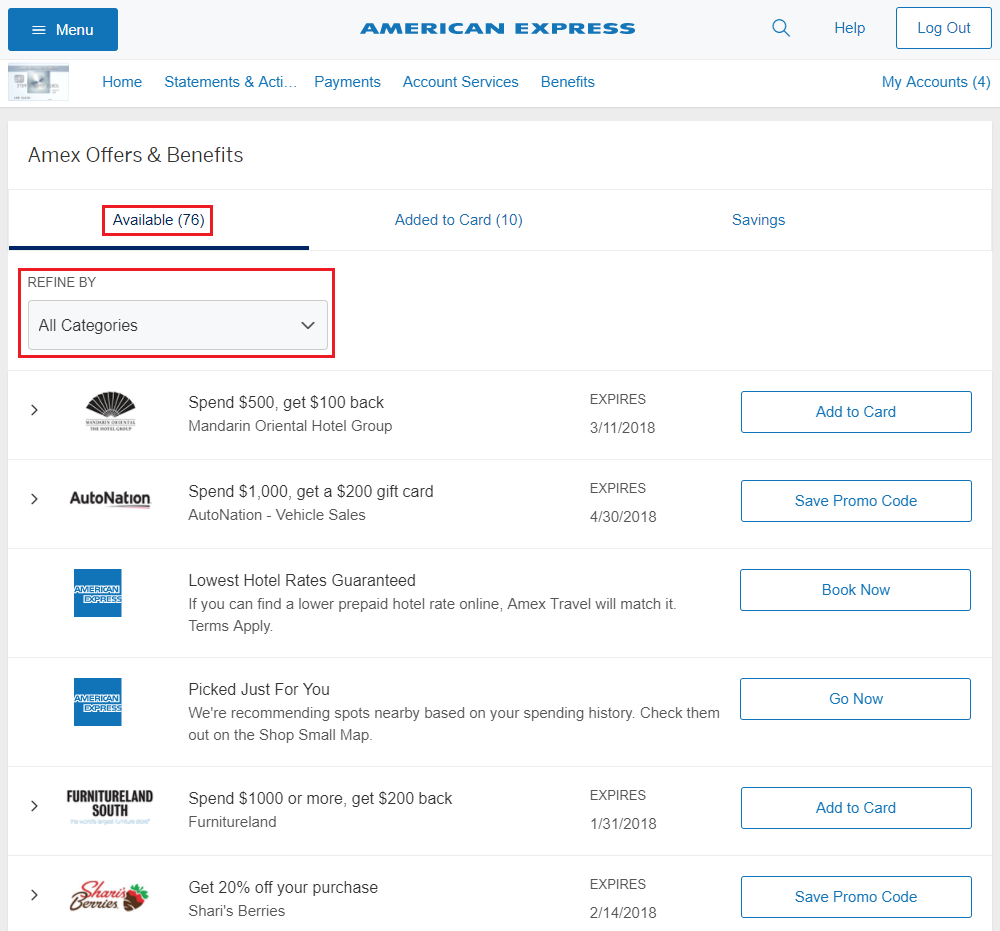

Comments

Q: Ought i located an announcement out of account off my personal financing servicer? A: Sure. The loan servicer need certainly to thing for you an announcement out-of membership after every line of credit interest. The loan servicer should matter to you personally a statement telling you of any following rate of interest transform which can effect the reverse home loan. On top of that, the loan servicer must make available to your a yearly statement regarding membership by January 30 and this information all previous year’s reverse home loan membership hobby. Brand new yearly statement need to outline all of the improves out of prominent, all the Mortgage Insurance costs accumulated, most of the desire costs, and all sorts of possessions charges paid-in the earlier season.