While Signature loans are in fact readily available, it is essential to be a responsible debtor and simply incorporate to own eg fund when you really need all of them. Here are some four situations where a consumer loan is sensible.

India features mainly been a loan-averse country. A lot of people, particularly the seniors, favor way of living inside their mode and preserving for future years alternatively than borrowing and paying down. Although this mindset has the masters, there are numerous circumstances inside our modern existence where providing Individual Fund produces far sense.

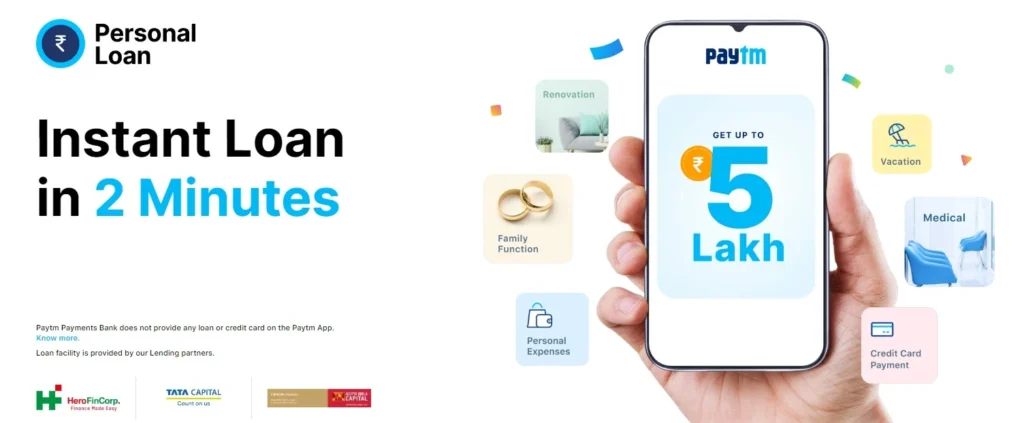

step 1. Medical Issues

Even if you have an emergency loans to own scientific costs, the high cost off healthcare in the united kingdom often produces such funds inadequate. Also, the kind of such issues can be in a way that you desire fast access in order to financing. Many of the financial institutions today approve Unsecured loans on a single day of software to ensure that you could create such as for instance emergencies and certainly will allow the good health care towards family. Having minimum Consumer loan qualification conditions, getting rest assured that the chances of loan acceptance is highest.

2. Investing Credit card bills

While Playing cards was strong monetary units, they’re a weight if loans in Rosa for people with bad credit you don’t utilized responsibly. Just like the rate of interest off Unsecured loan tends to be below that of Playing cards, taking a personal loan to invest Credit card statement are a great great decision as well. You could potentially capture a consumer loan immediately after which pay back a similar inside the month-to-month instalments more a period of just one-five years. This can help you help save a lot of currency.

step three. House Restoration

A new condition where you may require an unsecured loan try home recovery. There are various type of restoration standards off a home which are date-sensitive and painful. For example, fixing a primary leaks before monsoon or and make some developments on domestic prior to trying to offer an equivalent. If you do not keeps enough discounts to possess particularly renovations and you may developments, a personal loan is also very well manage the expenses. As there is no limitation regarding how the loan amount is also be used, Unsecured loans was very flexible.

cuatro. Advanced schooling

The work field during the India and all sorts of over the world try today extremely aggressive. This will make it extremely important for all the functioning elite group to modify their knowledge and you can enjoy on a regular basis. Nowadays there are various sorts of programs that can assist that improve his/their particular career candidates. While struggling to would this new charges of these programs yourself, delivering a consumer loan are a alternative. This can help you make the most of finest top-notch opportunities and you may earn more. Due to the fact Unsecured loan conditions are minimum, also anyone who has has just already been performing could possibly get the loan accepted.

5. Relationship Expenditures

Big pounds wedding events was a bit a standard in the country. However, the entire wedding fling will be pricey. Though its your wedding or of somebody in the all your family members, an economic problem is usually inescapable. A personal bank loan is an ideal solution to do the expense out-of a married relationship. Which have financial institutions today giving Signature loans of up to Rs.20 lakh, you are able to have the financial help you will want to appreciate the marriage exactly as you’d envisioned.

Capitalizing on an unsecured loan

Every type regarding loan is right as long as you know what you are really doing as well as have a powerful repayment package from inside the place. If you’re there are several scenarios in which providing a consumer loan renders experience, the people listed above is several finest examples.

Use the Unsecured loan qualification calculator on the internet to test your eligibility before applying to make certain that the loan application is instantly approved with no complications.