Are you a home upgrade venture but worried about the latest financial load this may impose? Search no further! In this article, we will mention an often skipped solution which can help you financing your home developments: the brand new 401k mortgage. Of the leveraging retirement coupons, you can make use of straight down rates of interest, flexible payment terminology, and potential taxation pros. Sign-up us even as we look into the huge benefits, constraints, and you may procedures locate a great 401k mortgage to possess do-it-yourself, in addition to worthwhile methods for increasing the fool around with.

Benefits of using a great 401k Mortgage having Do-it-yourself

With regards to investment your residence improvement project, a 401k financing even offers multiple appealing benefits that make it a common selection for many home owners.

All the way down Rates of interest Versus Almost every other Loan Choice

Among high advantages of an excellent 401k financing is the usually all the way down rates of interest in comparison to almost every other loan choices, eg personal loans otherwise handmade cards. Because of this borrowing from the bank from the 401k will save you a great considerable amount of cash when you look at the attention repayments along side mortgage name, so it is a payment-energetic provider for your house improvement needs.

No Credit score assessment or Being qualified Conditions

In lieu of conventional money, a great 401k mortgage doesn’t need a credit check or strict qualifying conditions. This will make it an obtainable selection for those with quicker-than-perfect fico scores otherwise those who might have issue conference the qualifications standards out of almost every other loan applications. Your retirement savings act as collateral, eliminating the need for detailed papers and borrowing from the bank examination.

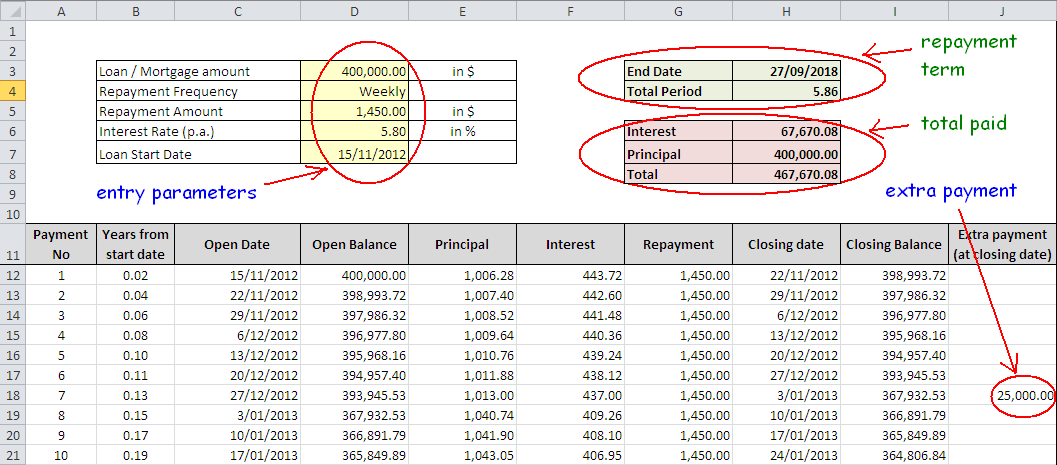

Independence inside the Repayment Terms

401k financing promote independency in the fees terminology, allowing you to personalize the borrowed funds with the finances. You can normally pay back the mortgage during a period of five years, while some plans can get stretch the fresh new cost months for renovations. This added liberty ensures that you could easily manage your mortgage costs if you’re nonetheless progressing to your retirement desires.

Potential Taxation Masters

A unique enticing facet of using a beneficial 401k loan to have do it yourself is the prospective income tax advantages this may bring. While contributions so you can a good 401k are generally made towards a good loans in Glencoe pre-tax base, financing costs manufactured which have after-income tax cash. Although not, whenever paying down the borrowed funds, the eye you have to pay is not subject to tax, efficiently lowering your nonexempt money. So it taxation virtue normally subsequent increase the cost-abilities of using a great 401k mortgage for your house improve investment.

Understanding the Limits of good 401k Mortgage getting Home improvement

While a 401k mortgage will likely be a feasible selection for financing your residence improve venture, it is very important to understand its limitations and you may prospective drawbacks prior to making a choice.

Potential Fines

Getting financing from your 401k can get involve fees and penalties. If you’re unable to pay the mortgage according to the assented-upon terminology, it’s also possible to deal with punishment and taxes into an excellent equilibrium. On the other hand, certain employers can charge administrative charge to possess processing the mortgage. It is very important meticulously review new small print out-of the 401k financing in advance of investing be sure you know about any potential fines.

Impact on Senior years Savings

Credit out of your 401k could affect your retirement coupons in many means. First and foremost, the total amount you obtain will briefly slow down the money available for funding, potentially impacting the development of advancing years nest-egg. Furthermore, for folks who exit your job otherwise was ended, the a great loan equilibrium may become due instantaneously. Failing continually to repay the mortgage for the given time can also be produce it being treated because a shipment, subjecting one taxes and prospective very early detachment charges.